EIA: U.S. Summer Driving Season Remains Strong

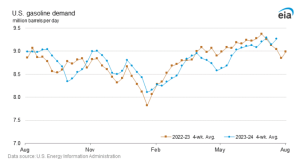

According to the latest data from the Energy Information Administration (EIA), the summer driving season is proving more resilient than expected. Despite earlier predictions of an early end, domestic gasoline demand has surged, showing that American drivers are still hitting the road in significant numbers.

Last week, gasoline demand in the U.S. climbed by 673,000 barrels per day (b/d) to reach 9.456 million b/d, marking the highest level this year. This figure also surpasses the demand seen in comparable weeks of 2022 and 2023. Ethanol-blended gasoline consumption mirrored this trend, with an estimated usage of about 9.2 million b/d.

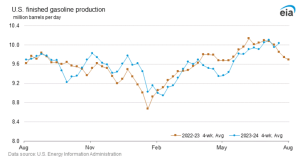

Refiners have responded to this increased demand by ramping up gasoline production to 10.213 million b/d, the highest level recorded in 2024 and the seventh consecutive week since mid-May with production exceeding 10 million b/d. This strong domestic demand, coupled with a rise in exports to a three-week high of 915,000 b/d, contributed to a significant overall stock draw of 5.6 million barrels.

Without adjusting for ethanol blending, gasoline output remained solid at 9.948 million b/d. The 5.6 million barrels drawn from U.S. storage marked the largest one-week decline since early March. Import levels also played a role in stabilizing the market, with imports calculated at 778,000 b/d last week, an increase of 50,000 b/d from the previous week.

The majority of the gasoline stock declines occurred east of the Rockies, particularly in the Midwest (PADD 2), where holdings fell by 2 million barrels. This decline is attributed to a reduction in refinery runs in the region, which decreased by 180,000 b/d, lowering utilization by 4.2 percentage points to 92.5% of capacity. This decrease was likely due to operational downtime at ExxonMobil’s Joliet, Illinois refinery following a power outage caused by severe storms on July 15.

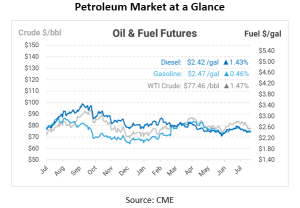

Nationally, total refinery runs fell by 388,000 b/d, bringing the total to 16.787 million b/d. Consequently, U.S. refinery utilization dropped by 2.1 percentage points to 91.6%. The reduction in refinery operations significantly impacted distillate output, which fell by 292,000 b/d to a four-week low of 4.937 million b/d. This lower output, coupled with robust exports, led to a 2.8-million-barrel stock draw. Distillate exports averaged 1.581 million b/d last week, increasing the four-week average to 1.412 million b/d.

Similar to gasoline, the largest distillate stock draws were concentrated east of the Rockies, with the East Coast (PADD 1), Midwest (PADD 2), and Gulf Coast (PADD 3) experiencing declines of 700,000 to 900,000 barrels. Distillate demand also saw a notable increase, rising by about 275,000 b/d week over week to a one-month high of 3.861 million b/d.

Jet fuel demand is also showing positive signs, with production remaining above 1.9 million b/d at 1.961 million b/d last week. Demand rebounded to 1.758 million b/d, pushing the four-week average to 1.716 million b/d. Despite the strong production and demand figures, jet fuel stocks rose by a modest 100,000 barrels last week.

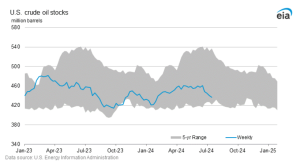

The EIA also reported a fourth consecutive weekly decline in U.S. crude oil stocks, which fell by 3.7 million barrels. Over the past four weeks, 24.2 million barrels have been drawn from storage, leaving total crude oil holdings at 436.486 million barrels, the largest deficit to the five-year average since mid-December 2022.

However, there is no immediate concern regarding total inventories. Crude oil exports increased above 4 million b/d to 4.186 million b/d, a rise of 222,000 b/d week over week. The current four-week average of 4.138 million b/d indicates the U.S. is exporting about 15% more crude oil than last year.

Some of the crude oil draw was associated with the Cushing, Oklahoma storage hub, where stocks fell by 1.7 million barrels to 31 million barrels, the lowest since late February. The steep backwardation in the market has reduced incentives for storing barrels at this hub.

In summary, the latest EIA data underscores the resilience of the U.S. summer driving season, with strong gasoline and distillate demand, robust refinery output, and significant draws from storage indicating sustained market activity despite earlier predictions.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.