Bearish Sentiment and US Election Fears Dominate Oil Markets

Investor sentiment turned bearish this morning due to weighing concerns surrounding the US election and a stronger US dollar, which increased demand concerns. Brent crude prices fell to levels not seen since early June and are currently sitting $3 below the $80/bbl mark. Tensions are also weighing between Israel and Yemen as the hopes of a ceasefire in the Gaza conflict linger.

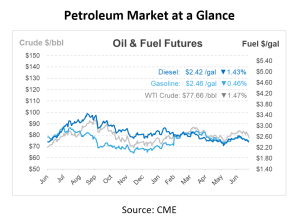

Diesel futures settled higher on Monday, while the August WTI contract expired at a five-week low. There was notable backwardation between the August and September contracts, with the September WTI settling at $78.40/bbl, down 24 cents. The September Brent contract also fell, settling down 23 cents. Contango between the September and August diesel contracts remains under 2 cents. This firming of product contracts boosted crack spreads, with the NYMEX 3:2:1 crack spread rising to $23.48/bbl.

Russia’s Tuapse oil refinery, the largest on the Black Sea, was damaged in a major Ukrainian drone attack on Monday, causing a fire that has since been contained. The extent of the damage is unclear, and there were no reported casualties. The refinery processes 240,000 bpd and supplies fuel to Turkey, China, Malaysia, and Singapore. This attack is part of Ukraine’s systematic targeting of Russian energy infrastructure, retaliating against Russian strikes on Ukraine’s energy system. Russia’s defense ministry reported that 75 drones launched by Ukraine overnight were destroyed, including eight near Tuapse. The refinery has been targeted multiple times since the war began in 2022.

On the domestic front and in light of the upcoming US election, market participants are eyeing the introduction of the Energy Permitting Reform Act of 2024. This bipartisan effort was introduced to address industry headaches surrounding oil production on federal lands. The act aims to improve coordination, reduce permitting wait times, lift the LNG export ban, and restore certainty to Gulf of Mexico leasing, enhancing American energy security. The act includes new offshore oil and gas lease sales provisions, boosting domestic energy production, job creation, and economic growth. It also addresses litigation reform to prevent project delays and supports offshore wind lease sales to promote progress in emission reduction efforts. The bill hopes to balance climate challenges with affordable, secure energy solutions for Americans and allies.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.