Week in Review: Oil Prices Rising as Beryl Withers Away and Canada Wildfires Spread

Crude oil futures are keeping gains from yesterday after the EIA predicted a strong build in distillate stockpiles last week. Prices finished higher yesterday following the government’s release of lower-than-anticipated June inflationary data. A recent slowing in price increases may pave the way for a rate drop by the Federal Reserve as early as the latter part of the summer, according to Labor Department data released Thursday morning. The June Consumer Price Index increased 3% over the previous year because of the increased expectations for demand. Lower interest rates often mean higher gasoline costs.

Over one million Texans are still without power after the storm hit the Texas Gulf Coast earlier this week. The Port of Houston has fully reopened following Hurricane Beryl after receiving clearance from the US Army Corps of Engineers and the US Coast Guard, as announced by the Greater Houston Port Bureau. While the Houston ship channel no longer has draft restrictions, other Texas ports, including Galveston, Texas City, and Freeport, still have restrictions in place, which are under review. The reopening of Port Houston is expected to alleviate concerns about potential disruptions to refined product shipments from the region, especially since Gulf Coast refineries were operating at 97% capacity just before the hurricane. The rapid return to full capacity at Port Houston should help clear any vessel backlog and enable resources to be directed towards surveying and reopening the remaining restricted ports.

Around Fort McMurray, the unofficial oil sands capital of Canada, a cluster of wildfires has broken out, posing further risks to the extraction of crude oil from the third-largest petroleum reserves in the world. In addition to the three massive oil-sands mine fires blazing to the north, eight other uncontrolled fires have been found south and southwest of the city. Alberta’s wildfire season is gentler this year than it was last, with fewer flames and a smaller burnt area despite the latest flare-up. There are 74 fires raging in Quebec’s eastern province right now, although most are still at low to moderate risk levels.

The U.S. Energy Information Administration (EIA) has raised its Brent oil price forecasts for 2024 and 2025 in its latest short-term energy outlook (STEO). The EIA now predicts that the Brent crude spot price will average $86.37/bbl this year and $88.38/bbl next year, up from the previous estimates of $84.15/bbl for 2024 and $85.38/bbl for 2025. The report also forecasts that Brent spot prices will fluctuate between $86 and $90/bbl through the first half of 2025. The EIA noted that oil prices, averaging $82/bbl in June, are expected to rise due to OPEC+ production cuts and current global inventory levels.

In the same report, the EIA highlights that global oil inventories are expected to decrease by an average of 0.8 Mbpd from the third quarter of 2024 through the first quarter of 2025. However, it anticipates that the market will see moderate inventory builds in 2025 following the expiration of OPEC+ supply cuts and increased supply from non-OPEC+ countries. The EIA forecasts Brent prices to average $88/bbl in 2025. Heightened tensions in the Middle East and recent attacks on shipping vessels have added a risk premium to oil prices.

Prices in Review

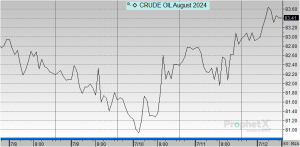

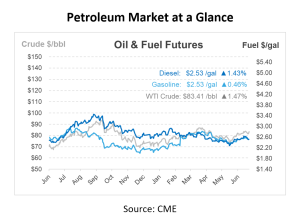

Crude opened the week at $83.15, dropped the following two days, and started increasing on Thursday. This morning, crude opened at $82.86, an overall decrease of 29 cents or -0.348%.

Diesel opened on Monday at $2.609 and has seen modest drops throughout the week. This morning, diesel opened at $2.5241, a decrease of 8 cents or -3.254%.

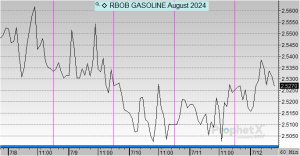

Gasoline opened on Monday at $2.564, and also saw modest decreases through Thursday. This morning, gasoline opened at $2.5248, a decrease of 3 cents or -1.52%

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.