What’s That: Sustainable Aviation Fuel (SAF)

Imagine a future where jetting off on a vacation or business trip doesn’t leave a hefty carbon footprint in its wake. In today’s What’s That Wednesday, we’ll take to the air and review the intricacies of Sustainable Aviation Fuel (SAF), exploring its sources, benefits, and the obstacles it faces. We’ll also discuss how SAF producers can generate carbon credits, paving the way for a more sustainable future in aviation. The seatbelt sign is on as we embark on a comprehensive journey through the world of Sustainable Aviation Fuel.

What is sustainable aviation fuel?

SAF is a renewable fuel used to power aircraft, produced from sustainable resources rather than crude oil. When blended at the maximum 50% blend, it is designed to be a replacement for conventional jet fuel, meaning it can be used in existing aircraft engines and jet fuel infrastructure without modifications. Today, SAF is most commonly produced from a variety of biomass-based feedstocks, including waste oils, fats, and greases such as used cooking oil, animal fats, and other waste oils. However, new and emerging technology, such as alcohol-to-jet, is paving the way for SAF to be produced from additional feedstocks, including ethanol.

Benefits of Sustainable Aviation Fuel

Neat SAF can reduce lifecycle greenhouse gas emissions by up to 80% compared to traditional jet fuel. This large reduction is primarily due to the renewable nature of the feedstocks and the carbon sequestration capabilities of plants and waste materials used in their production. By diversifying jet fuel sources, SAF reduces fossil fuel dependency and enhances energy security. This diversification is crucial as it mitigates the risks associated with geopolitical tensions and oil price volatility. As governments worldwide tighten regulations on carbon emissions, SAF provides a viable pathway for airlines to meet these requirements and avoid penalties. Additionally, businesses can reduce their Scope 3 corporate travel emissions by contributing to airlines sustainable fuel investments.

Challenges of Sustainable Aviation Fuel

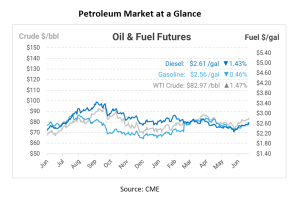

Currently, biomass-based SAF is approximately 2-3 times more expensive than conventional jet fuel. This cost disparity is due to the limited availability of feedstocks, the complexity of refining processes, and the nascent stage of the industry. The availability of sustainable feedstocks is limited. Large-scale production of SAF requires a consistent and sustainable supply of raw materials, which can be challenging to secure without affecting food security and land use. Scaling up SAF production to meet global aviation demand requires significant investment in infrastructure. This includes building new biorefineries, upgrading existing facilities, and developing efficient supply chains. SAF must meet stringent regulatory standards for safety and performance. Navigating these regulations can be time-consuming and costly for producers and by extension, consumers

SAF Credits and Incentives

In 2021, the Biden Administration announced the SAF Grand Challenge, with the ambition to increase the domestic production of SAF. The U.S. is targeting to produce 3 billion gallons of SAF by 2030, and 35 billion gallons by 2050. To support this initiative, the U.S. government has established tax credits for SAF production of up to $1.75 per gallon through 2027.

In addition to the federal tax incentive, SAF producers can generate carbon credits, particularly through participation in Low Carbon Fuel Standard (LCFS) programs. These programs, established in regions like California, Oregon, and Washington state, as well as parts of Canada, incentivize the production and use of low-carbon fuels by awarding credits based on the carbon intensity (CI) of the fuel.

While the LCFS program has successfully attracted a significant portion of the nation’s lowest carbon-intensity fuels by combining the LCFS value to Renewable Identification Numbers (RINs), the market has experienced some challenges. In the past two years, structural oversupply of LCFS and RIN credits has led to a decrease in their respective values, which in turn has limited the financial support for airlines purchasing SAF.

In response to the reduced credit values, some producers have opted for a higher profit margin by prioritizing renewable diesel (RD) production over SAF, whereas other producers have shifted towards more affordable feedstocks. While this approach helps control costs, it has also resulted in an increase in the average CI score for biomass-based SAF. Despite these challenges, the SAF market is poised for rapid growth, driven by substantial investments and increasing demand as U.S. air travel returns to pre-pandemic levels.

Federal and State initiatives play a pivotal role in the broader adoption of SAF by providing financial support for reducing carbon emissions. As the market evolves, ensuring a fair and competitive price for SAF will be essential to meeting the environmental goals of the aviation industry and supporting the transition to more sustainable fuels.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.