Oil Markets React to Geopolitical Tensions and Supply Dynamics

This morning, prompt crude futures experienced a drop, declining by over 50 cents per barrel, reversing most of yesterday’s gains. The previous day’s increase of 90 cents per barrel was driven by escalating geopolitical tensions in the Middle East, rising attacks on ships in the Red Sea, and support from broader markets due to a weaker US dollar. The spread between August and September 2024 West Texas Intermediate (WTI) contracts remained steady at 77 cents per barrel, while the Brent spread for the same months narrowed by 5 cents to 86 cents per barrel.

In China, refiners and fuel suppliers are projected to export 3.19 million tons of crude products in July, a decrease from June’s 3.72 million tons. This marks the second consecutive monthly decline in oil product exports, highlighting weaker domestic demand despite strong export and manufacturing sectors. China’s macroeconomic data reveals a divergent economy with robust export performance but persistent weaknesses in the housing market. Export growth contributed 2.4 percentage points to the 5.3% year-over-year real GDP growth in Q1.

Meanwhile, Mexico’s state oil company reported an 11% increase in gasoline imports in May, totaling 383.5 thousand barrels daily. However, domestic gasoline refining fell by 10% to 267 thousand barrels per day, the lowest in five months, as the company continues to recover from a refinery fire in April.

Managed money participants saw a mixed week with a net length increase of 68,000 lots, primarily driven by Brent crude. WTI crude net length decreased by 6,000 lots due to a rise in both short and long positions. During this period, prompt crude futures prices climbed by over $3.70 per barrel.

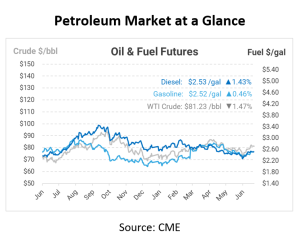

Crude oil and distillate futures closed higher on Monday, marking the fifth gain in six sessions for crude and ultra-low sulfur diesel (ULSD). However, gasoline futures fell slightly, marking their first decline in the same period. The NYMEX August and September WTI contracts rose to $81.63 per barrel and $80.86 per barrel, respectively. Brent contracts also saw gains, with the August contract settling at $86.01 per barrel.

ULSD futures increased by nearly 3 cents per gallon, with the July contract closing at $2.5214 per gallon. Gasoline futures were volatile throughout the session, with the July RBOB contract ending at $2.5115 per gallon, down by 0.22 cents.

Supply concerns continue to support futures prices following OPEC and its allies’ decision to extend voluntary crude oil production cuts. This has led to warnings about potential supply shortfalls during the busy U.S. summer driving season. Recent Energy Information Administration (EIA) data has shown an uptick in fuel demand, further supporting prices. The EIA will release new demand data on Wednesday, which market participants will closely watch.

In summary, the crude oil market remains volatile, influenced by geopolitical tensions, supply dynamics, and varying demand patterns across major economies. As the market navigates these complexities, stakeholders must closely monitor upcoming data releases and geopolitical developments to gauge future price movements.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.