What’s That: Petroleum Cracking

This week, we’re cracking into a cornerstone of the modern fuel industry, a process known as petroleum cracking. It transforms less useful heavy hydrocarbons into the fuels that power our vehicles, heat our homes, and keep industries running. We’ll also clarify how it relates to—and differs from—fracking and provide insights into crack spreads that you may see in your pricing.

What is Petroleum Cracking?

Petroleum cracking, also known simply as “cracking,” is a chemical process used in oil refineries to break down larger, heavier, and more complex hydrocarbon molecules into simpler, lighter ones. This transformation is needed because lighter hydrocarbons, such as gasoline, diesel, and jet fuel, are in higher demand than the heavier oils they originate from.

How Does Petroleum Cracking Work?

The process of cracking involves subjecting heavy hydrocarbon molecules to high temperatures and pressures, or catalytic agents, to break their chemical bonds. There are several methods of cracking, including:

Thermal Cracking

Thermal cracking is a refining process that breaks down complex long-chain hydrocarbons into lighter molecules by applying high temperatures, utilizing free radicals—reactive species with unpaired electrons but no charge. This process, pioneered by William Merriam Burton in 1913 for Standard Oil Company (Indiana), produces low-octane gasoline from gas oil.

Catalytic Cracking

More efficient and widely used today, catalytic cracking utilizes a catalyst, usually a form of acidic silica-alumina, which helps lower the temperature and pressure needed for the reaction, saving energy and increasing yield.

Hydrocracking

A combination of high pressure and the presence of hydrogen gas, along with a catalyst. This method not only breaks down molecules but also saturates them with hydrogen, removing impurities and improving the quality of the final products.

Cracking vs. Fracking: What’s the Difference?

While both “cracking” and “fracking” are terms used in the industry, they refer to different processes. Petroleum Cracking is a chemical process used in refineries to break down heavy oil into lighter, more usable products. Fracking, short for hydraulic fracturing, is a method used in the extraction phase of oil and gas production. It involves injecting high-pressure fluid into underground rock formations to create cracks, allowing oil and gas to flow out more freely to be collected at the surface. Essentially, fracking increases the availability of oils and gases from the earth, while cracking makes those oils into usable products.

Why is Cracking Important?

Cracking enhances fuel accessibility and helps maintain a balance between fuel supply and demand. The term ‘supply’ denotes the proportion of oil processed by refineries, whereas ‘demand’ describes the volume of products consumers are ready to buy at certain prices. During crude oil fractional distillation, there’s a production imbalance, with larger hydrocarbons being more abundant compared to the more sought-after smaller hydrocarbons. Thus, cracking is important in refining long-chain hydrocarbons into high-efficiency short-chain hydrocarbons like gasoline. Cracking transforms raw crude oil into various by-products, including cooking oil, ethanol, liquefied petroleum gas, diesel, and jet fuel. Compounds such as branched and cyclic alkanes are added to further enhance gasoline’s quality and increase its octane rating.

The Relation of Cracking and Crack Spreads

The process of cracking is directly related to the concept in the oil refining industry known as the “crack spread.” The crack spread is a financial term used to describe the difference in price between crude oil and the petroleum products derived from it through the cracking process, such as gasoline and heating oil. This spread is used by industry analysts and traders to gauge the profitability of an oil refinery.

The more effectively a refinery can perform the cracking conversion, the more profit it can potentially make from the crude oil it processes. The prices of crude oil and the products obtained from it can vary independently based on market demands and other factors. For instance, gasoline prices might rise during the summer driving season or fall during winter, independently of crude oil price movements.

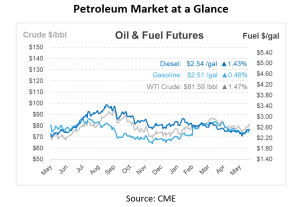

Crack spreads are calculated by subtracting the price of crude oil from the combined prices of the petroleum products produced from it. For example, if a refinery buys crude oil at a certain price per barrel and sells gasoline and diesel at higher prices, the difference represents the crack spread. This spread is often expressed per barrel of crude oil and can be calculated for different product mixes, such as the 3-2-1 crack spread (three barrels of crude producing two barrels of gasoline and one barrel of diesel). Refineries use crack spreads as a hedge against price volatility. By analyzing crack spreads, refineries can make informed decisions about their operations, such as when to buy crude oil, when to process it, and when to sell the finished products to maximize profitability.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.