Summer Driving Season Boosts $80 Crude as Legal Battles Loom

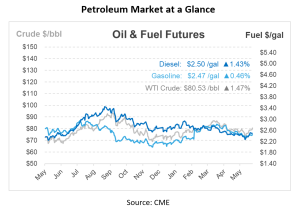

Crude futures remain above $80/bbl this morning after Monday’s gains. Yesterday, the August Brent contract gained $1.63 to settle at $84.25/bbl, while WTI increased by $1.88 to settle at $80.33/bbl. The US dollar was trading lower yesterday as equity futures were higher, also contributing to the rise in crude prices. Some market analysts predict that prices could continue rising throughout the summer months. There is also conjecture that if prices increase another $5/bbl, the US may approve a sale from the Strategic Petroleum Reserve.

Texas, Louisiana, and Mississippi filed a lawsuit against the United States government to stop the Biden administration’s planned rule that would have required the offshore oil and gas sector to guarantee around $7 billion in funding for demolishing outdated infrastructure. The majority of smaller businesses without investment-grade ratings or sufficient proved oil reserves will be impacted by the rule, which is scheduled to go into effect later this year. The conditions are more likely to be met by larger oil firms. The Bureau of Ocean Energy Management, which believes the rule may affect around 75% of operators in the Gulf of Mexico, is the subject of the case. Old well decommissioning can be expensive, and if firms don’t fulfill their responsibilities, taxpayers may be stuck with the bill. Approximately 1.8 million barrels of oil are produced daily in the U.S. Gulf of Mexico, accounting for 14% of all U.S. output.

Portfolio investors bought back part of the oil they had sold the week before, following Saudi Arabia’s and its OPEC+ allies’ emphasis that future production increases would depend on the state of the market. Last week, the equivalent of 80 million barrels were purchased. Approximately 40% of the 194 million barrels that were sold the week before were bought back after OPEC+ said that it would begin raising output in October.

Refiners are losing money on gasoline sales due to lower-than-anticipated demand during the summer driving season. Many refiners had boosted production with hopes of a busy season and are now falling short of expectations. At the beginning of the month, a 1.7% decrease in US gasoline demand to 9 Mbpd materialized, which was seasonally the lowest since 2021. Run cuts have already occurred from weakening in the gasoline market in Asia, and refiners worldwide will likely begin to draw back in the coming weeks. This might lower the demand for crude oil worldwide.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.