Natural Gas News – June 6, 2024

Natural Gas News – June 6, 2024

Futures Surge on Hot Weather Forecasts

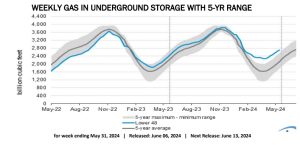

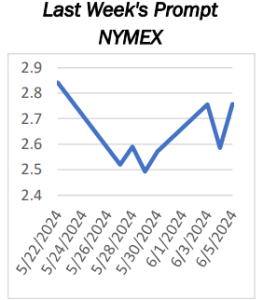

Natural gas futures are trading sharply higher ahead of the U.S. government’s weekly storage report, indicating a bullish market sentiment. Forecasts of warmer-than-normal temperatures across the U.S. drive natural gas demand, with highs reaching the mid-100s in some areas. An outage at Norway’s Nyhamna gas plant boosts European prices, potentially increasing U.S. LNG exports to maximum capacity. Natural gas futures are trading sharply higher ahead of the U.S. government’s weekly storage report, set for release at 14:30 GMT. The report is expected to show a build of 89 Bcf, slightly up from the previous week’s 84 Bcf build. At 13:06 GMT, Natural Gas futures are trading $2.861, up $0.104 or +3.77%. Today’s rally is largely driven by forecasts predicting strong weather-related demand.

Much of the U.S. will experience… For more info go to https://tinyurl.com/59jkwjy5

Natural Gas Sells Off After JOLTS Release

Natural Gas prices take a turn for the worse and fall lower. Meanwhile the option markets were flashing red warning signs of overheating. The US Dollar Index jumps higher on Tuesday on safe haven inflow after it sank on Monday. Natural Gas price (XNG/USD) is giving up earlier gains and drops by 1% at the start of the US session on Tuesday after a more than 6% surge on Monday on reports that Norway was facing delivery issues in its Gas supply to Europe. Gas prices shot higher after the news amidst the refueling season for Europe ahead of next fall and winter. However, some headwinds are emerging for an extension of that rally with the options markets tilted to an overstretched long position, which might get set to become unwinded for profit-taking. Meanwhile, the US Dollar Index (DXY),

which… For more info go to https://tinyurl.com/nrwzz86j

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.