Canada: Trans Mountain Pipeline Ships First Oil Load

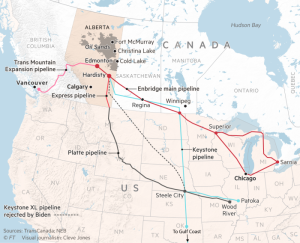

On May 22, the newly expanded Trans Mountain pipeline terminal saw its first oil tanker set sail, carrying approximately 550,000 barrels of tar-sand oil bound for China. This shipment marked the start of TMX’s commercial operations, which now feature an additional capacity of 590,000 barrels per day (bpd) of crude oil transportation from Alberta to Canada’s Pacific coast.

Economic and Market Impacts

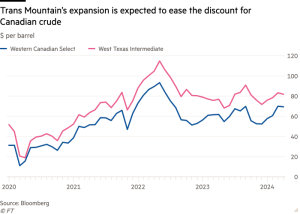

Oil production in Alberta has climbed to record levels in anticipation of the pipeline expansion. The discount for Western Canadian Select (WCS) has narrowed from about $19 a barrel at the start of 2024 to about $12 at the end of April. A recent report by the Bank of Canada projects that Trans Mountain will contribute around 0.25 percentage points to the country’s second-quarter economic growth.

According to MEG Energy Corp., the expanded pipeline will boost Canadian oil prices for years. Historically, Canadian heavy oil has sold at a discount to lighter US crude due to differences in product quality, transportation costs, and limited pipeline export capacity. This discount has been severe at times, with Western Canada Select selling at nearly $50 per barrel below the US benchmark West Texas Intermediate in the fall of 2018.

However, the TMX expansion changes the dynamics by providing an additional 590,000 barrels per day of pipeline capacity and opening new markets for oilsands products in Asia and along the US Pacific Coast. Prices for Canadian heavy oil increased, and the WCS-WTI differential narrowed in April in anticipation of the pipeline’s start-up. MEG Energy expects Canada’s oil producers to get better prices for years as the industry begins using the expanded pipeline.

Challenges and Financial Overview

The TMX has been in development for 12 years, enduring multiple challenges, cost overruns, and shifting political winds. Environmental and indigenous groups opposed its construction, and the Canadian federal government bought out the original owner, Kinder Morgan, in 2018 to ensure its completion. Under government management, construction costs soared from US$9 billion in 2020 to US$15 billion by 2022, with the final cost reaching about US$23 billion for Canadian taxpayers.

The expanded pipeline marks a paradigm shift for the tar sands industry. Without domestic access to the sea, Canadian heavy crude had to be sold into the US market or to international buyers via US pipelines. This gave American refiners leverage on pricing, and Canadian producers had few alternatives. Now, producers can market their output directly to customers in China without incurring the cost of pipeline shipment to the US Gulf Coast. Since February, Alberta’s benchmark Western Canadian Select blend has been trading for about eight percent more than West Texas Intermediate, reversing a longstanding trend.

Broader Market Implications

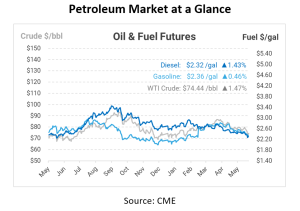

The TMX could also impact US diesel prices. The Midwest, historically benefitting from cheaper Canadian crude, may see higher costs as the Canadian oil discount decreases. The Western Canadian Select’s discount to US benchmark West Texas Intermediate is expected to shrink from about $17.10 per barrel to less than $10 a barrel between May and July, the first time in single digits since April 2021. This change will likely raise costs for US refiners in the Midwest, who rely heavily on Canadian oil, and potentially increase diesel prices for Midwestern drivers.

The expanded TMX is expected to benefit refiners on the US West Coast. The pipeline provides a cost-effective alternative to Alaskan and Californian oil, making the market more competitive. Canadian crude, shipped via internationally flagged tankers, offers lower shipping costs than domestically transported Alaskan oil.

Overall, the Trans Mountain pipeline expansion marks a significant development for the Canadian oil industry, providing new market access, potentially higher prices, and a shift in the North American oil supply dynamics.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.