Week in Review – May 31, 2024

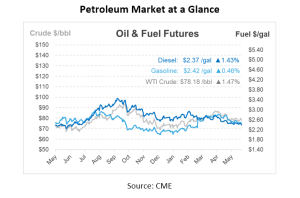

Crude futures are up over 20c/bbl this morning, while U.S. equity futures and the dollar are trending lower ahead of the April PCE report due later today. WTI and Brent crude prices both fell by over $1 /bbl yesterday, marking the third consecutive day of losses. This decline occurred despite the EIA reporting a 4.2 Mbbl draw, exceeding Reuters’ estimated 2 Mbbl draw. For the month, prompt WTI and Brent are on track to close down by $4 /bbl and $6 /bbl, respectively. Additionally, prompt Brent has weakened into a bearish contango structure for the first time since January.

Markets are now focused on the upcoming OPEC meeting this Sunday, where OPEC is expected to maintain current production cuts. OPEC+ is negotiating a deal to extend some of its strong oil production cuts into 2025. This deal may include extending cuts of 3.66 Mbpd into 2025 and voluntary cuts of 2.2 Mbpd into late 2024. OPEC+ reportedly aims to agree on new oil production capacities for its member countries by the end of 2024.

Asia’s independent refiners saw a decrease in imports due to a drop in domestic margins, while India’s imports of Russian oil grew by 50% in the second quarter of the year compared to the first. This month, China is expected to import the least amount of Russian crude in more than three years. Due to tight Brent-Dubai pricing gaps and expensive Persian Gulf-Asia tanker insurance payments, South Korean refiners are using more US crude than Persian Gulf-Asia. While US oil imports have climbed by 13.8% year to date, South Korea’s petroleum imports from Saudi Arabia and Kuwait decreased by 5% and 33% YoY, respectively, in April. Yet, a free trade agreement between the UAE and South Korea that eliminates a 3% duty on UAE crude for the next ten years might render oil supplies from the UAE more affordable in the future.

According to Wednesday’s DOE report, refinery utilization increased by over 2%, reaching 94.3%, indicating there is still some capacity for a slight increase. Consequently, crude oil saw a decent draw on inventory, while diesel and gasoline experienced substantial inventory builds.

Despite diesel days of supply decreasing to 31.4 from the recent April high of 34 days, the increased refinery utilization alleviates immediate concerns about diesel supply. Nonetheless, the risk of hurricanes this year along the Texas/Gulf Coast and East Coast remains a significant concern. Given that overall diesel supply is still relatively low, any major storms in these regions need to be closely monitored and taken seriously due to their potential impact on supply.

Prices in Review

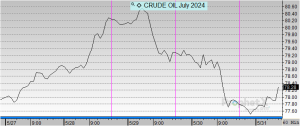

In a short week of trading due to the Memorial Day holiday, crude opened on Tuesday at $77.81. Crude increased on Wednesday before decreasing the next two days. This morning, crude opened at $77.91, an increase of 10 cents or 0.13%.

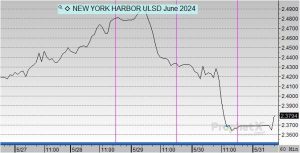

Diesel opened on Tuesday at $2.4148 and increased on Wednesday before dipping for the rest of the week. Diesel opened this morning at $2.369, a decrease of nearly 5 cents or -1.86%.

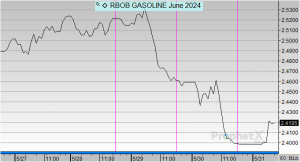

Gasoline opened the week on Tuesday at $2.4964 and increased on Wednesday before tapering off the rest of the week. This morning, gasoline opened at $2.3987, a drop of about 10 cents or -3.913%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.