Week in Review – May 24, 2024

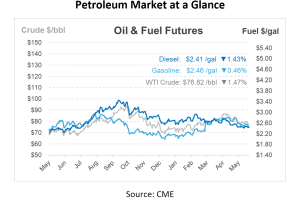

Oil prices are continuing their weekly decline this morning due to persistent concerns that stubborn inflation might extend the period of higher interest rates, potentially reducing fuel demand. This morning, prompt crude futures dipped by 5 c/bbl, hovering near three-month lows and on track for a weekly decline of $3/bbl. Earlier today, OPEC+ announced they have rescheduled their output policy meeting to June 2nd and will conduct it online instead of in person in Vienna.

Yesterday, prompt crude prices fell by 70 c/bbl, marking the fourth consecutive day of losses, possibly influenced by broader market pressures as equity futures declined and the US dollar appreciated. However, the US dollar weakened this morning, and equity futures rose ahead of the US Memorial Day long weekend.

The latest update from the U.S. Energy Information Administration (EIA) shows a declining trend in U.S. regular gasoline prices, with prices recorded at $3.643/gal on May 6, $3.608/gal on May 13, and $3.584/gal on May 20. Despite the recent decline, the May 20 price was still $0.05 higher than the same time last year. Regionally, the West Coast had the highest price at $4.624/gal, while the Gulf Coast had the lowest at $3.113/gal. As of May 23, the average price of regular gasoline in the U.S. was $3.615/gal according to AAA.

Looking ahead, the EIA’s short-term energy outlook projects that the average U.S. regular gasoline price will be $3.54/gal over 2024 and 2025. Prices are expected to fluctuate quarterly, with peaks in the third quarters of each year. The EIA also highlighted the potential impact of refinery operations on gasoline prices during the summer. In March 2024, the price breakdown for regular gasoline included 56% for crude oil costs, 19% for refining, 15% for taxes, and 10% for distribution and marketing. The diesel price breakdown was slightly different, with higher proportions allocated to distribution and marketing.

The minutes from the Federal Reserve’s latest policy meeting, released on Wednesday, revealed discussions about the possibility of increasing interest rates due to persistent inflation. Higher interest rates raise borrowing costs, potentially limiting funds that could drive economic growth and oil demand in the U.S., the world’s largest oil consumer. Additionally, U.S. crude inventories rose by 1.8 million barrels last week, as reported by the EIA, contrary to the anticipated 2.5 million barrel decrease. On a global scale, physical crude markets have been under pressure due to weak refinery demand and abundant supply.

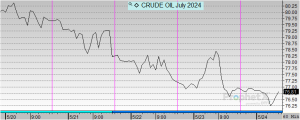

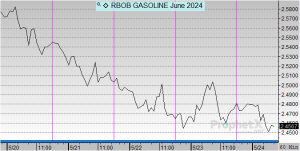

Prices in Review

Crude opened on Monday at $80.01 and saw a steady decline for the remainder of the week. This morning, crude opened at $77.04, a decline of $2.97 or -3.71%.

Diesel opened the week at $2.4884 and also saw steady drops throughout the week ahead of the holiday weekend. This morning, diesel opened at $2.4175, a decline of 7 cents or -2.85%.

Gasoline trended similarly, with a declining week opening at $2.5786. This morning, gasoline opened at $2.4757, a decrease of 10 cents or -3.99%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.