Week in Review – May 17, 2024

Petroleum futures closed higher on Thursday, driven by increased optimism regarding potential U.S. interest rate cuts. This boosted investor interest in riskier assets such as equities and energy commodities. Earlier in the day, the Dow Jones Industrial Average surpassed the 40,000 mark for the first time in history, buoyed by upbeat U.S. jobless claims data. Expectations of a stronger global economy are signs of potential increased fuel demand.

Although equities ended the day slightly lower yesterday, energy futures remained higher. Yesterday, prompt crude futures rose by approximately 60 c/bbl and are now poised to end the week up by around 50 c/bbl. This increase follows a cooler-than-expected CPI report and a decline in US crude stockpiles. Brent is on track for its first weekly gain of 0.4% in three weeks due to economic indicators from major consumers, China and the United States, which have raised hopes for increased demand. WTI, on the other hand, is set for a 1% weekly gain.

After only being back in operations since early May due to an attack in January, Russia’s Tuapse refinery on the Black Sea was hit with Ukranian drone strikes early this morning. The strikes caused a fire at the facility, which will again halt operations.

Speaking of fires, wildfires in Alberta could potentially threaten more than 2.1 Mbpd of Canadian oil sands production, according to a market update from Rystad Energy. Although the fires have not yet impacted oil operations, worsening conditions could change that. This potential threat represents about 2.6% of the region’s total crude oil and condensate supply. The situation recalls the fires in May and June 2016, which took significant production offline. Despite improved wildfire danger ratings, evacuation orders remain in place. Oil sand operators are also planning maintenance this month, which will temporarily reduce production. In a worst-case scenario, up to 2.13 Mbpd could be affected, potentially increasing price volatility. Synthetic grades from upgrading facilities are likely to see the largest impacts.

China is looking to accelerate the replenishment of its crude stocks, seizing the opportunity presented by lower crude prices this month. Over the past month, the country has added more than 30 million barrels to its inventories, marking the fastest rate in a year. While China does not publicly reveal the size of its crude reserves, some analysts estimate that the nation can store over 1 billion barrels in strategic and commercial stockpiles. In comparison, the US has a storage capacity of 714 million barrels.

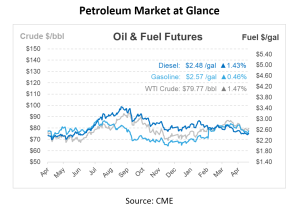

Prices in Review

Crude opened the week on Monday at $78.18 and traded within a little over $1/bbl for the remainder of the week. This morning, crude opened at $79.38, and increase of $1.20 or 1.53%.

Diesel opened the week at $2.4314 on Monday, saw a marginal increase on Tuesday, and dipped slightly on Wednesday and Thursday. This morning, diesel opened at $2.4516, an increase of 2 cents or 0.83%.

Gasoline opened on Monday at $2.51 and saw a marginal increase on Tuesday before dipping on Wednesday. Gasoline has since been trading higher and opened at $2.5428 this morning, an increase of 3 cents or 1.31%.

This article is part of Uncategorized

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.