Oil Market Shifts as It Eyes April Reports and OPEC Decisions

Global oil markets are grappling with economic forecasts as industry eyes turn to pivotal developments that could shape the next few months regarding supply and demand. This morning, crude is trading down over $1/bbl while the market is anticipating the release of the April PPI and PPI reports. Crude futures closed higher in Monday’s NYMEX trading, whereas refined products experienced mixed outcomes. Monday’s session was marked by uncertainty, described by some traders as “noisy” due to a lack of solid market convictions. The general consensus is that shifts in oil markets are unlikely until the OPEC+ meeting on June 1 or possibly not until the third quarter, when gasoline demand could stabilize the unsettled second quarter.

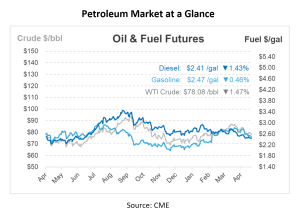

On Monday, crude benchmarks rose, with June WTI climbing 86 cents to $79.12/bbl and July Brent crude advancing 57 cents to $83.36/bbl. Mixed performance was witnessed in refined products, with distillates decreasing slightly but gasoline prices showing minor increases. There is speculation that gasoline demand could exceed 9.5 Mbpd during the Memorial Day week, influenced by travel projections. The AAA predicts that around 38.4 million individuals will hit the roads for the upcoming holiday weekend. The outcome for gasoline prices may hinge on whether U.S. refiners can jumpstart 300,000 bpd or secure the Gulf Coast refining capacity currently under maintenance.

OPEC has reiterated its expectation for global oil demand growth in 2024, forecasting an increase of 2.25 Mbpd and 1.85 Mbpd in 2025, with these projections unchanged from the previous month. This announcement comes ahead of the June 1 meeting, where OPEC and its allies, including Russia, will decide whether to continue voluntary output reductions into the latter half of the year. These cuts, which total 2.2 Mbpd, aim to stabilize the market and are set to expire at the end of June unless extended.

OPEC+ has been the primary platform for oil market collaboration since 2016 under the Declaration of Cooperation. Reflecting this role, OPEC has decided to cease publishing its calculations of global demand for its crude alone, choosing instead to focus on the demand for OPEC+ crude. This shift aims to enhance solidarity within the group and reduce potential misunderstandings about market dynamics.

The report also highlighted the divergence in demand growth forecasts among various agencies, attributed partly to differing views on the speed of transition to cleaner energy sources. For instance, the IEA, which sees oil demand peaking by 2030, predicts a lower expansion rate of 1.2 Mbpd for 2024.

In contrast, OPEC remains optimistic about the continued rise in oil use over the next two decades without foreseeing a peak. The latest figures indicate that OPEC+ produced 41.02 Mbpd in April, slightly below the projected demand of 43.2 Mbpd for 2024, while OPEC’s own output was 26.58 Mbpd, showing a decrease of 48,000 bpd. This realignment of focus to OPEC+ highlights the group’s commitment to leading global oil market strategies amidst evolving economic and environmental landscapes.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.