Oil Prices Hold Steady Amidst Macroeconomic Data and Global Supply Concerns

Crude oil began the day showing signs of stability, as prices held relatively steady following an overnight surge of approximately 40 cents per barrel. This movement unfolds among the release of pivotal macroeconomic indicators in the United States, including data on goods orders, consumer confidence, and the anticipated revised GDP figures for the fourth quarter of 2023. These economic metrics serve as crucial benchmarks, offering insights into the overall health of the economy and exerting a profound impact on investor sentiment within the oil market.

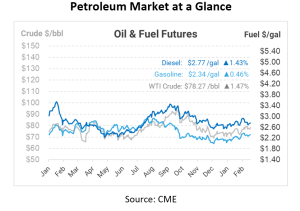

Yesterday’s trading session witnessed WTI climbing over $1 per barrel higher, with Brent also recording an uptick of around 90 cents per barrel. These gains were potentially spurred by multiple factors, including robust US physical prices and a temporary shutdown in exports from Libya’s Wafa oil field due to labor disputes.

Meanwhile, Russia’s four-week average crude export shipments soared to their highest level since November 2023, slightly surpassing the country’s pledged OPEC+ export target. This surge, likely propelled by the resolution of export impediments from January, underscores Russia’s pivotal role in global oil markets.

Additionally, Russia’s announcement of a six-month ban on gasoline exports starting March 1st aims to stabilize domestic prices and facilitate refinery maintenance. With Russia producing 43.9 million tons of gasoline in 2023, this move could have significant implications for global gasoline markets, particularly for major importers such as African countries.

The recent surge in US crude prices reflects strong refinery demand and heightened foreign interest in American crude amidst Red Sea shipping disruptions. WTI prices have soared to year-to-date highs, imposing a premium of approximately $2 per barrel over Nymex WTI prices. Prolonged refinery maintenance in the US has led to a drawdown in diesel and gasoline inventories despite moderate demand levels.

Conversely, European imports of US diesel have plummeted this month, mirroring a decline in US refinery utilization rates to the lowest levels since December 2022. This sharp drop follows January’s record-high imports of US diesel, highlighting the impact of changing supply dynamics on global trade flows.

Despite the volatile trading environment, oil prices have exhibited resilience, underpinned by geopolitical tensions and supply constraints. Analysts from Goldman Sachs and Bank of America anticipate rangebound trading in the near term, focusing on potential extensions of OPEC+ production cuts. The widening of Brent’s prompt spread into a deeper backwardation pattern signals tightening market conditions, providing further support for prices.

Furthermore, the industry is closely monitoring upcoming events, including the release of US inflation data, decisions on OPEC+ production cuts, and the American Petroleum Institute’s weekly U.S. crude inventories data, scheduled for release later today. These events are expected to provide more valuable insights into market dynamics, potentially influencing future trading strategies and market sentiment.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.