Crude Futures Slip as Red Sea Conflict Escalates, Economic Indicators and Policy Moves Take Center Stage

Crude oil futures dipped over 30 cents per barrel lower this morning, marking a cautious start to the trading week as the industry braces for the expiry of the Mar24 WTI futures contract. The energy market landscape remains tense as geopolitical tensions escalate in the Red Sea region, with the Houthis continuing their attacks on shipping lanes. Over the weekend, at least four more vessels were hit by drone and missile strikes, adding to concerns about supply disruptions.

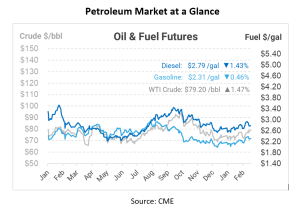

According to Reuters, Brent prices settled roughly unchanged yesterday, with lower liquidity attributed to the President’s Day holiday in the United States. However, last week saw both prompt WTI and Brent prices surge, with gains of $2.38 per barrel and $1.39 per barrel, respectively. This sentiment was fueled by ongoing conflicts in the Red Sea region, leading to shipping delays and supporting physical crude markets.

Meanwhile, in China, efforts to stabilize the economy continue as record cuts to the country’s benchmark reference rate were announced. The People’s Bank of China (PBOC) delivered the largest-ever cut to the 5-year Loan Prime Rate (LPR) on February 20th, reducing it from 4.20% to 3.95%. This move aims to bolster the property market and support economic growth amidst global uncertainties. Analysts note that these measures may influence crude oil demand in the world’s largest importer.

In the US, economic indicators have been closely watched by analysts. The latest data showed a significant spike in owners’ equivalent rents (OER), surprising many economists. This spike, the largest since 1995, has raised questions about the inflation outlook and potential policy responses. Additionally, core producer prices came in stronger than expected in January, prompting adjustments to gross domestic product (GDP) forecasts by some analysts.

In Russia, oil processing volumes continued to decline last week due to refinery damages caused by recent drone attacks. This decline in refinery rates has contributed to lower crude oil output, adding to supply concerns in the global market.

On the drilling front, the US crude oil net rig count decreased slightly, reflecting ongoing adjustments in response to market conditions. Managed money participants have increased their net length positions, particularly in Brent crude, indicating growing bullish sentiment among investors.

Overall, the evolving situation in the Red Sea region and developments in major economies such as China and the United States are expected to continue shaping the trajectory of crude oil prices in the coming weeks.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.