Natural Gas News – November 14, 2023

Natural Gas News – November 14, 2023

Natural Gas Prices Forecast: Cold Snap Forecast Triggering

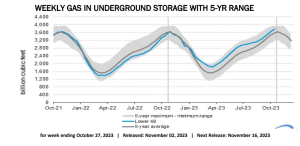

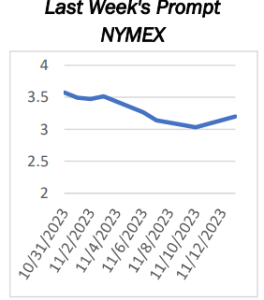

U.S. natural gas futures have ticked upward the past two sessions as revised forecasts predict colder temperatures than previously anticipated, sparking a surge in demand expectations. This adjustment follows a consistent trend of increasing heating requirements as the nation approaches the heart of the winter season. Market movement has been directly influenced by NatGasWeather’s reports, which show an uptick in Heating Degree Days (HDDs), a measure of demand, particularly over the next 8-15 days. Despite a short-term outlook of light demand, the forecasts have shifted from bearish to more balanced as seasonal demand aligns closer to expectations. The rally in gas futures also comes

ahead of the Energy Information Administration’s (EIA) resumed weekly gas storage report, with analysts anticipating the season’s….For more info go to https://shorturl.at/rxzDN

12 Most Undervalued Natural Gas Stocks To Buy

In this article, we discuss the 12 most undervalued natural gas stocks to buy according to hedge funds. To skip the detailed analysis of the natural gas sector, go directly to the 5 Most Undervalued Natural Gas Stocks To Buy According To Hedge Funds. Since Russia invaded Ukraine in 2022, the oil and gas sector has shown a lot of volatility. Last year, crude oil per barrel price briefly hit its 13-year peak of nearly $130 in March. The Henry Hub natural gas spot price averaged around $8.81 per Metric Million British Thermal Units (MMBtu) in August 2022 and averaged around $6.42 per MMBtu for the full year. However, a mild winter and healthy LNG inflows in Europe led to a decline in gas prices since its peak. By the first quarter of 2023, the average gas prices were around $2.55 per

MMBtu, s… For more info go to https://shorturl.at/DORWY

This article is part of Daily Natural Gas Newsletter

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.