Saudi Arabia & Russia Extend Cuts through 2023 – Oil Prices Rally

Crude oil futures remain near year-to-date highs despite the ever-changing shifts in market dynamics. After a rally pushed crude prices to their annual high last week, a major announcement from Saudi Arabia and Russia today is continuing the push. The kingdom announced they plan to maintain 1 MMbpd cuts through the end of 2023, while Russia’s 300 kbpd export reduction will also continue during that period. The market had expected only a 1-month extension, so the extra months added to the move’s bullishness.

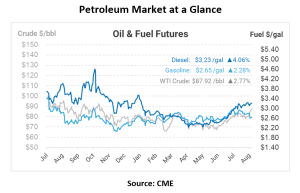

Last week’s rally was primarily driven by China’s stimulus measures and expectations of further production cuts by the OPEC+ alliance. Brent and WTI crude touched peaks of $88.99/bbl and $86.14/bbl, respectively, resulting in a week-long gain of over 7%. These gains were a reflection of market optimism regarding China’s economic recovery and the anticipation of production cuts by OPEC+ members.

Recent fluctuations in crude oil prices have been significantly influenced by Chinese economic data. A decline in business activity, as revealed by the latest Chinese economic indicators, triggered a nearly $1/bbl drop in crude prices from their recent highs. China’s economic health continues to wield substantial influence over crude oil markets, given its stature as a major global oil consumer.

An analysis conducted by Global Investment Research (GIR) provides insights into the impact of OPEC+ production cuts on the crude oil landscape. The analysis suggests that the return to production deficits, facilitated by three rounds of cuts from Saudi Arabia and its OPEC+ partners since September 2022, has resulted in a significant global supply deficit of 2.3 million barrels per day (mb/d) in Q3. This return to deficits has played a pivotal role in driving oil prices higher – and the cut extensions will cause this to persist in Q4.

GIR’s perspective on the global economic landscape diverges from conventional forecasts. The continued positive inflation and labor market news has led GIR to cut their estimated 12-month US recession probability further to 15%, down 5pp from their prior estimate and their lowest typical forecast based on a recession coming every seven years.

Russian Exports, US Rig Counts, and Managed Money Participants

In August, Russia witnessed an 11-month low in seaborne oil exports, attributed to refinery maintenance and output cut commitments. Geopolitical tensions impacted Russian crude shipments, particularly from the Black Sea, though these declines were partially offset by alternative shipping routes. Simultaneously, the US crude oil net rig count remained stable at 512 rigs, signaling consistency in drilling activities.

Managed money participants’ behavior is also noteworthy. WTI Crude net length increased, with more long positions and fewer short positions. In contrast, Brent’s net length decreased. This suggests varying perceptions of market direction among participants, contributing to market complexity.

The current landscape of crude oil markets underscores the intricate interplay between supply and demand dynamics, geopolitical tensions, economic data, and investor sentiment. As demonstrated by recent price fluctuations, a combination of factors can trigger significant movements in crude oil prices. While OPEC+ production cuts and stimulus measures influence sentiment, China’s economic health and global economic views continue to be critical in shaping the future trajectory of crude oil prices.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.