Week in Review – June 2, 2023

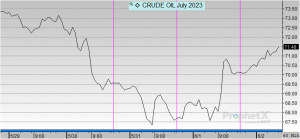

On Tuesday, oil markets started on a higher note, as oil futures were up by $1.20/bbl. Meanwhile, a few tremors from the political and economic fronts influenced the market rhythm, keeping the players on their toes. The ascension began during the overnight session on Sunday, continuing well into the morning. However, the tranquility was short-lived as a nearly $5/bbl dip from Tuesday through Wednesday left the market in shock. The rollercoaster ride didn’t end there, though. Thursday saw a revival, rallying back from the steep descent.

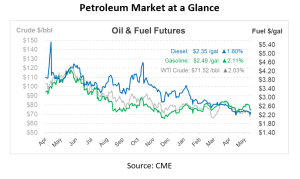

Yesterday, crude oil traded within an approximately $2/bbl range. The slight stability was ushered in by a smaller-than-anticipated crude build reported by the US Energy Information Administration (EIA), measuring up to 4.5 million barrels. The report also detailed a modest draw of 0.2 million barrels in gasoline and a build of 1.0 million barrels in distillates. This fell closely in line with Reuters’ estimates of 0.5 million barrels of gasoline draw and 0.9 million barrels of distillate build. As a result, gasoline and distillate inventories were reported to be 8% and 18%, respectively, below their five-year averages for this period. Despite the market turbulence, crude inventories stood firm at 2% below the five-year average for this time of year.

Equity futures, too, joined the upward trend while the dollar softened, following the US Senate’s green light to a bill designed to increase the debt ceiling. The bill, coupled with the Federal Reserve’s June meeting and mixed data concerning China’s reopening, captured the market’s attention throughout the week.

On the US oil production front, March witnessed an increase of 171k bpd month-over-month, reflecting the enduring impact of soaring prices during the second and third quarters of 2022. This growth, constituting almost 10% year-over-year in the first quarter of 2023, may, however, dwindle in light of a recent 7% decrease in the US oil rig count last month compared to the peak in December 2022.

Looking ahead, all eyes are on OPEC+ and their highly anticipated meeting this weekend in Vienna. OPEC+, consisting of the Organization of the Petroleum Exporting Countries and Russia-led allies, which together account for approximately 40% of the world’s crude production, hold significant sway over oil prices. Despite the oil price dip toward $70/bbl this week, sources within the alliance seem to suggest that further output cuts may not be on the table. However, with some sources maintaining ambiguity about the meeting’s outcome, the market waits with bated breath.

Prices in Review

Crude oil opened on Tuesday at $73.23 and dropped nearly $3/bbl two days in a row. This morning, crude opened at $70.21, a decline of over 3 dollars or -4.12%.

Diesel opened the week at $2.3838 and followed a similar path to crude oil by dropping on both Wednesday and Thursday. This morning, diesel is reversing some losses and opened at $2.3174, a decline of around 6 cents or -2.785%.

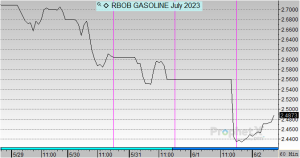

Gasoline opened the week at $2.7079 before steadily declining throughout the week. This morning, gasoline is also reversing some losses and is trading above yesterday’s numbers at $2.4485 but still an overall decline of 25 cents or -9.58%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.