Week in Review – May 12, 2023

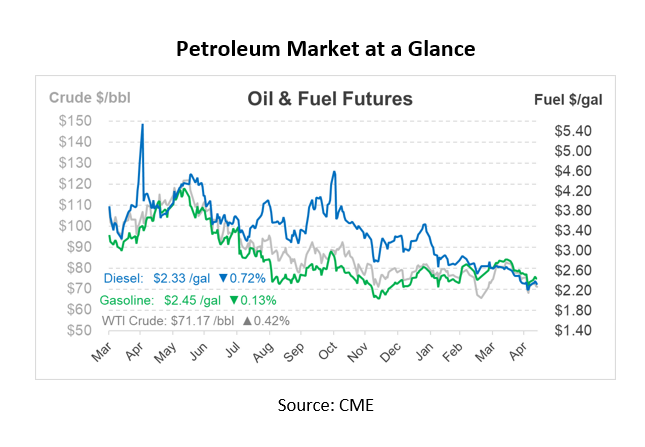

Oil prices stabilized today despite having been on track for the fourth consecutive weekly decline due to revived concerns about fuel demand growth in the United States and China, the world’s top two oil consumers. Both Brent crude futures and West Texas Intermediate (WTI) U.S. crude futures experienced drops, ending at $74.55 and $70.54 a barrel, respectively.

This downtrend is largely due to concerns about a potential recession in the U.S. and Europe, as well as a slower-than-anticipated demand recovery in China. The uncertainty was further fueled by unresolved U.S. government debt ceiling discussions, stoking fears of a looming financial crisis.

Throughout the week, the specter of inflation and possible interest rate increases by the U.S. Federal Reserve added to market concerns. Fed Governor Michelle Bowman asserted on Friday that if inflation remains high, further rate hikes would likely be necessary. She also noted that recent data hasn’t alleviated her concerns about persistent price pressures.

In the midst of this, the Organization of the Petroleum Exporting Countries (OPEC) remained cautiously optimistic in their monthly report for May. The group raised its forecast for Chinese demand and kept the 2023 global demand growth prediction steady at +2.3 million bpd. The report also noted uncertainties related to U.S. shale production and unplanned maintenance, with non-OPEC 2023 supply projected to grow by 1.4 million b/d.

In other key developments, the U.S. Department of Energy revealed plans to refill the Strategic Petroleum Reserve (SPR) starting in June, post a congressionally mandated drawdown. This comes as U.S. Energy Secretary Jennifer Granholm suggested the potential for repurchasing oil for the SPR once the mandated sale of 26 million barrels is completed in June. This statement followed her earlier comments which said the Department of Energy (DOE) might acquire crude oil priced at or below $67-$72 per barrel and potentially make purchases once repair work is concluded. Currently, the reserve stands at 372 million barrels, a record low since 1983, after offloading 180 million barrels in the previous year. The potential refill could provide support to the market in the coming weeks.

Prices in Review

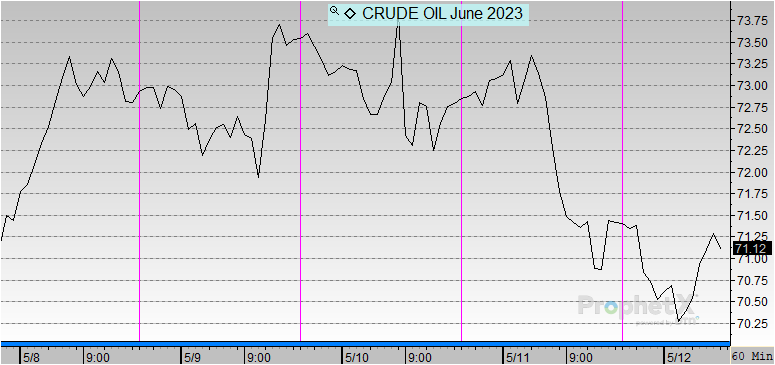

Crude opened the week at $71.35 before jumping to its high of $73.58 on Wednesday. This morning, crude opened at $71.42, a slight increase of 7 cents or 0.0981%.

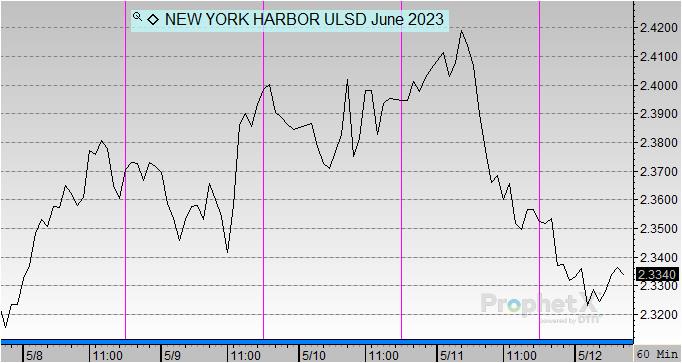

Diesel followed a similar path, opening at $2.3147 on Monday and climbing to its high of $2.3948 on Wednesday. This morning, diesel opened at $2.3588, a minor increase of nearly 5 cents or 1.905%.

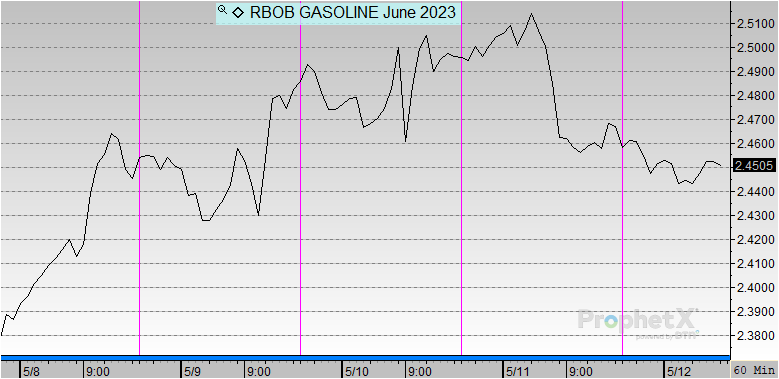

Gasoline saw the biggest uptick this week, opening at $2.3821 on Monday and slowly climbing day over day. Gasoline opened this morning at $2.4678, an increase of 8 cents or 3.6%.

This article is part of Daily Market News & Insights

Tagged: China, crude, crude prices, Daily Market News & Insights, demand, diesel, fuel prices, gasoline, Inventories, oil prices, opec, Supply

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.