Crude Futures Slide, Beaumont Refinery Expansion Bolsters US Capacity

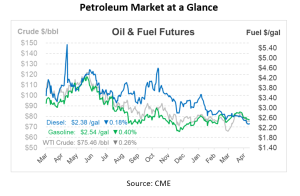

This morning, crude futures are down about 20 c/bbl, following the downward trend from yesterday’s session. The decline in crude prices is due to a combination of weakening demand, crack spreads and refinery margins, and a recent contraction in Chinese manufacturing activity – the first since December. Market participants are cautious about the possibility of multiple rate hikes by major banks, including the Federal Reserve and the European Central Bank.

The macroeconomic environment is not favorable for crude oil this morning, with weaker equities and a stronger dollar. Crude has lost more than 6% year-to-date, wiping out gains made after OPEC+ announced unexpected production cuts that will take effect this week. The downward trend continued yesterday as disappointing Chinese manufacturing data fueled concerns about the overall health of the economy, particularly in light of the recent banking crisis and the anticipated Federal Reserve rate hike decision on Wednesday.

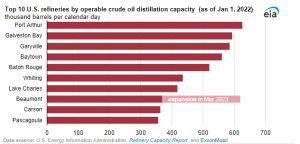

On March 16, ExxonMobil commenced operations at its Beaumont refinery expansion, boosting capacity by 250,000 b/d, making it one of the largest oil refineries in the US by crude oil distillation capacity. The company reports that the facility’s total capacity now stands at 630,000 b/d.

The Beaumont expansion is the first significant addition to refinery capacity since the COVID-19 pandemic, which led to several closures in 2020 and 2021. US refinery capacity decreased from 19 million b/d at the start of 2020 to 17.9 million b/d at the beginning of 2022. The added capacity at Beaumont is the largest among several expansions expected between 2023 and 2024, primarily focused on the US Gulf Coast. This region has long been the country’s largest refining hub, housing eight of the top ten largest refineries. These capacity increases capitalize on growing US crude oil production and take advantage of existing infrastructure for shipping refined products to the East Coast, Mexico, and other locations via coastal tanker facilities.

Increased refinery capacity should help lower fuel prices this summer compared to 2022. However, higher crude oil prices, rising consumption, and low fuel inventories could partially offset this. Global refinery capacity also decreased during 2020 and 2021, leading to reduced global inventories and increased reliance on US exporters. Additional international refinery capacity expansions are expected later this year, particularly in the Middle East, Nigeria, India, and China, which will likely contribute to a larger global supply of refined products and lower crack spreads.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.