Week in Review – April 21, 2023

Headlines this week have been focused on decelerating economic growth and the lackadaisical approach to the European sanctions in place against Russia. The even bigger news is the discussions of replenishing the strategic petroleum reserve and declining distillate oil inventories, though these were not enough to offset market losses.

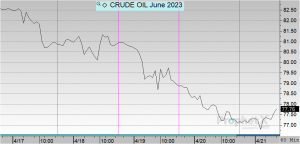

Throughout the week, crude oil prices sank to their lowest point since March 12. Prompt WTI and Brent dipped to their lowest levels at $76.72/bbl and $80.45/bbl, respectively. The strength of the US dollar contributed to this decline, although prompt oil futures experienced a slight recovery of about 20 c/bbl yesterday. Another contributing factor was bearish demand sentiment arising from worries over decelerating economic growth, the resumption of Kurdish exports, and weakening product margins. The market is on course for a weekly loss of around 6%.

Amos Hochstein, the Special Presidential Coordinator for Global Infrastructure and Energy Security, stated yesterday that the US could start refilling its Strategic Petroleum Reserve (SPR) as early as the third quarter of 2023. Hochstein emphasized that the administration is “100% committed to replenishing the SPR over a period of time” if prices are favorable come fall. However, he cautioned that the actual timeline depends on factors such as maintenance of the reserve’s infrastructure while it is half-empty and the effective management of the previously mandated sale of 26 million barrels by June 30th. President Biden has expressed his desire to buy at a target price below $70/barrel in order to refill the SPR.

Since the beginning of March, U.S. distillate fuel oil inventories, including diesel and heating oil, have been gradually declining, counteracting recent months’ buildups. This reduction is primarily attributed to a surge in exports. As of April 14, distillate stocks were at 112 million barrels, a decrease from 122 million on March 3, according to the EIA. Inventories were 18 million barrels below the prior ten-year seasonal average.

Distillate fuel oil consumption remains low due to the widespread decline in manufacturing and freight activity since Q3 2022. The anticipated shortage of distillates due to Russia’s invasion of Ukraine and subsequent U.S. and EU sanctions has not materialized among traders. Instead, the global industrial downturn, increasing interest rates, and a lenient approach to sanction enforcement have ensured sufficient distillates. Inventories consistently rose across North America, Europe, and Asia since reaching a low point in Q3 2022.

Prices in Review

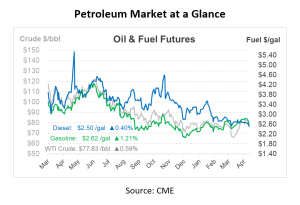

Crude oil opened the week at $82.48 and decreased by nearly $5/barrel between Monday and Thursday, with May 2023 WTI closing at $77.29/barrel yesterday – its lowest settlement since the end of March. This morning, crude opened at $77.13, a drop of $5.35 or -6.49%.

Diesel also saw steady declines this week in line with crude. It opened the week at $2.6464 and dropped each day of the week. This morning, crude opened at $2.4917, a decline of 15 cents or -5.85%.

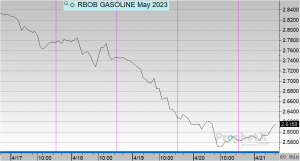

Gasoline opened on Monday at $2.8177 and also trended with crude and diesel this week with steady declines. This morning, gasoline opened at $2.5875, a loss of 23 cents or -8.17%.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.