Economic Concerns and Geopolitical Tensions Continue to Drive Oil Prices

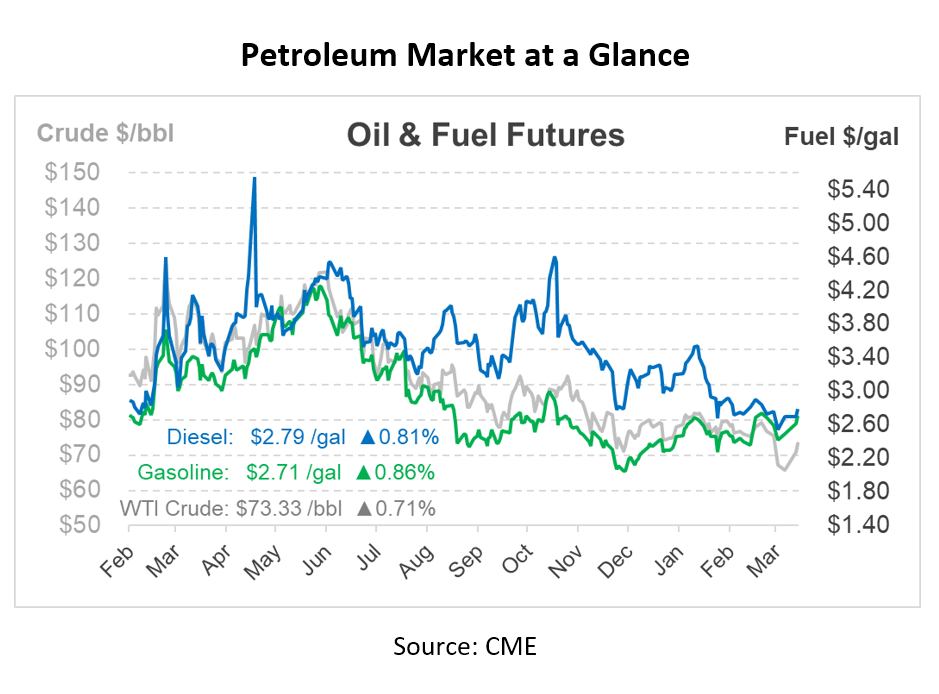

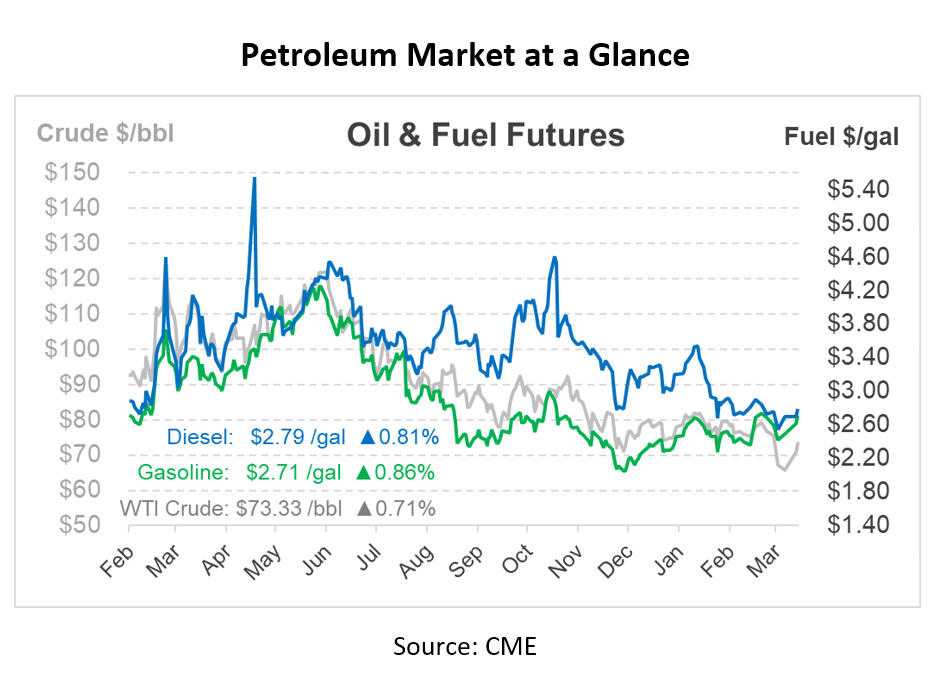

As economic and geopolitical concerns continue to weigh down on oil prices, markets are still processing the implications of the banking crisis. Crude oil is relatively unchanged this morning after a brief 50-cent per barrel increase earlier in the day. Equity futures and treasury yields are also exhibiting minimal movement as the market’s focus remains on the ongoing banking crisis and the anticipated release of February’s Consumer Price Index (CPI) data this Friday.

In a notable surge, crude oil futures experienced their largest single-day increase since October 2022 yesterday, jumping by over $3 per barrel. Despite recent spikes, crude oil is projected to close lower for the fifth consecutive month due to concerns of an economic downturn, a weakened financial sector, and higher-than-anticipated Russian supply exerting downward pressure on prices.

Yesterday’s spike in prompt crude can be attributed to several factors, including headlines announcing First Citizens Bank’s acquisition of parts of SVB, a slight uptick in equities, a depreciating US dollar, and news of halted supply from Northern Iraq following a court case resolution with Turkey. Recovery was sparked by a reduction of approximately 450 kbpd in exports from Iraq’s Kurdastan region, caused by disruptions to a pipeline in Turkey.

Despite the Kremlin’s pledge to reduce shipments, Russian crude exports have fallen by less than 500,000 barrels per day in March, according to Bloomberg. Russian crude oil production levels remain unexpectedly high, despite the Kremlin’s commitment to reduce output in response to Western sanctions. For the week ending March 24th, Russia’s shipments saw a decrease of only 123,000 barrels per day (bpd), significantly less than the promised cut of 500,000 bpd. In 2023, China and India have been the primary destinations for Russian crude exports, as no shipments have been sent to Northern Europe.

Recently, Russia’s Deputy Prime Minister acknowledged the need for the country to secure new insurance for its oil exports. This is due to the West’s refusal to insure shipments that exceed the price caps established by the European Union and the United States. This ongoing situation may potentially impact the availability and pricing of Russian crude oil in the global market.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.