Oil Prices – Gradually Recovering Despite Banking Stress, Recession Fears, and Investor Exodus

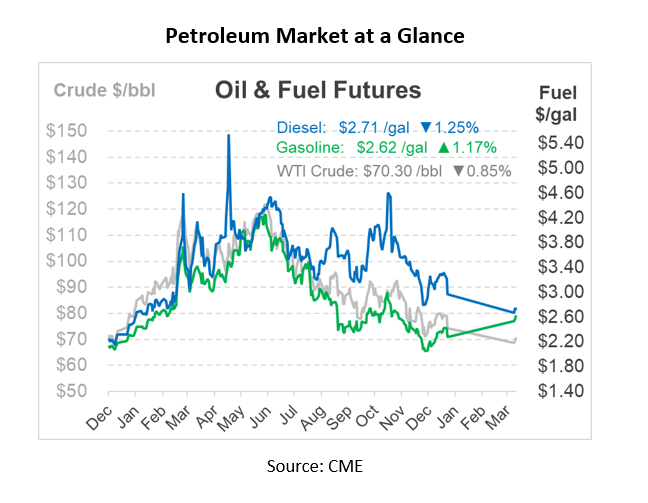

The world has witnessed a sharp decline in oil prices despite a China demand boom. Goldman Sachs attributes the recent decline to banking stress, recession fears, and an exodus of investor flows. However, historical data shows that after such scarring events, positioning and prices recover gradually, especially for long-dated prices. Indeed, that’s what we’re seeing this week, with crude rising $2.50/bbl from Friday’s 15-month low.

Goldman Sachs’ Global Investment Research (GIR) team recently incorporated this market feature in their framework and adjusted their Brent forecasts accordingly. They have nudged down their Brent crude oil forecasts to $94/bbl for 12 months ahead, and $97/bbl in 2024H2 (versus $100 previously for both).

This adjustment also reflects somewhat softer fundamentals, including higher-than-expected near-term inventories, moderately lower demand, and modestly higher non-OPEC supply. However, Goldman still believes that sharp rises in emerging market demand will outweigh moderate declines in developed markets’ demand, pivot the market back into deficits from June onwards, and drive the recovery.

In summary, despite the current challenges in the oil market, Goldman Sachs remains optimistic about a gradual recovery. It’s important to note that while these forecasts provide a useful guide, the oil market is highly volatile and subject to unforeseeable events that could significantly impact prices in either direction.

This article is part of Daily Market News & Insights

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.