Price Volatility Continues, Renewable Focus Brings Added Uncertainty

Analysis by Sydney Casey

Today, the Russian crude oil price cap will officially take effect at the agreed-upon $60/barrel. Every two months, the group will meet to reevaluate the price, but the cap must remain at least 5% below the average market rate. In addition, all EU members will have to unanimously agree to the new price cap before it goes into effect.

On Sunday, OPEC and its allies agreed to keep the group’s production cut at 2 million b/d through 2023. Weeks ago, the group had discussed possibly increasing their quotas. Over the past two weeks, though, low prices had sent sentiments in the opposite direction, with the group considering even deeper cuts. The decision comes with hopes that China will lift its COVID restrictions and reopen to sustain this demand in the future months.

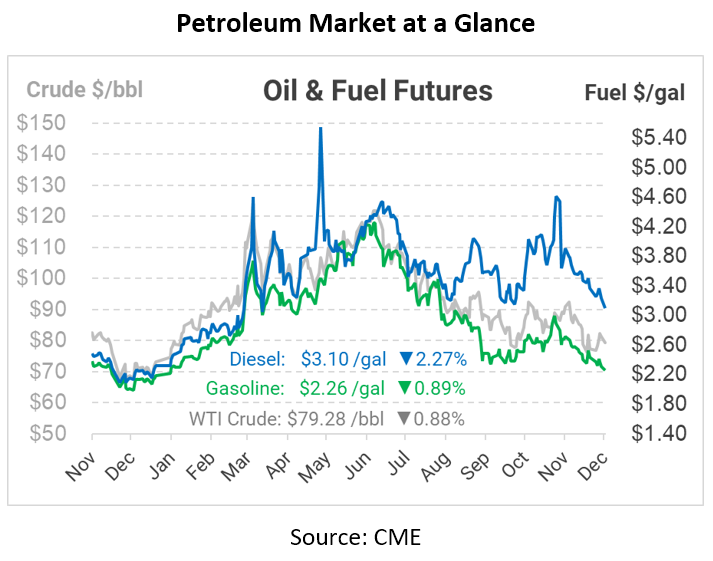

Diesel supply is also looking up after adding 5 million barrels to U.S. inventories after nearly three weeks of build-back. According to AAA, retail gasoline prices are on a downward spiral with current prices sitting around $3.33/gal. It is projected that by week’s end ten states will see average prices below $3/gal.

In other gasoline news, last summer, the U.S. ethanol blend rate climaxed at 10.5%, the highest calculated since 2007. The higher blend rate for the summer of 2022 was due to a combination of factors, including gasoline’s price increase because of tight inventories and capacity restraints at refineries.

The West Coast, specifically California, has different gasoline regulations than the rest of the country and faces supply constraints due to decreased refinery capacity. According to the EIA, West Coast refinery capacity has dwindled since 2020, subsequently making their gasoline prices even more sensitive to supply changes. This year alone, California saw price changes of over $1/gal in a matter of two months. In June 2022, California’s average retail gasoline price was $5.82/gal, while in August, it fell to a price of $4.94/gal and shot back up to $5.69/gal the first week of October. Luckily for the West Coast, November refining capacity was strong and allowed gasoline inventories to grow above a five-year average, paving the way for the lowest retail gasoline price since February.

Meanwhile, the Biden administration has a new focus on renewables. Over the next three years, Biden is looking to boost the amount of renewable fuels that oil refiners and importers must blend into their products. The EPA will require a blend of 20.82 billion gallons of renewable fuels into diesel and gasoline production by 2025. Clean Fuels Alliance America has since spoken out against this proposed volume by the EPA. “EPA’s overdue set proposal significantly undercounts existing biomass-based diesel production and fails to provide growth for investments the industry has already made in additional capacity, including for sustainable aviation fuel. The volumes EPA is proposing for 2023, 2024, and 2025 ignore the more than 3 billion gallons currently in the market and fail to take into account the planned growth of the clean fuels sector,” said Clean Fuels Vice President of Federal Affairs Kurt Kovarik.

Don’t get too comfortable with the downward spiral of gasoline prices and the upward trend of diesel supply. As uncertainty continues to loom around China’s COVID policies and the actual ramifications of the Russian price cap, we could see further volatility in fuel prices. Among other uncertainties is the future of renewable energy and how the Biden administration and the EPA will come to agreements over blend rates. With the rates not set in stone yet, we could see an abandonment of the policy or adoption that would drastically change the future of the energy industry.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.