Week in Review – September 23, 2022

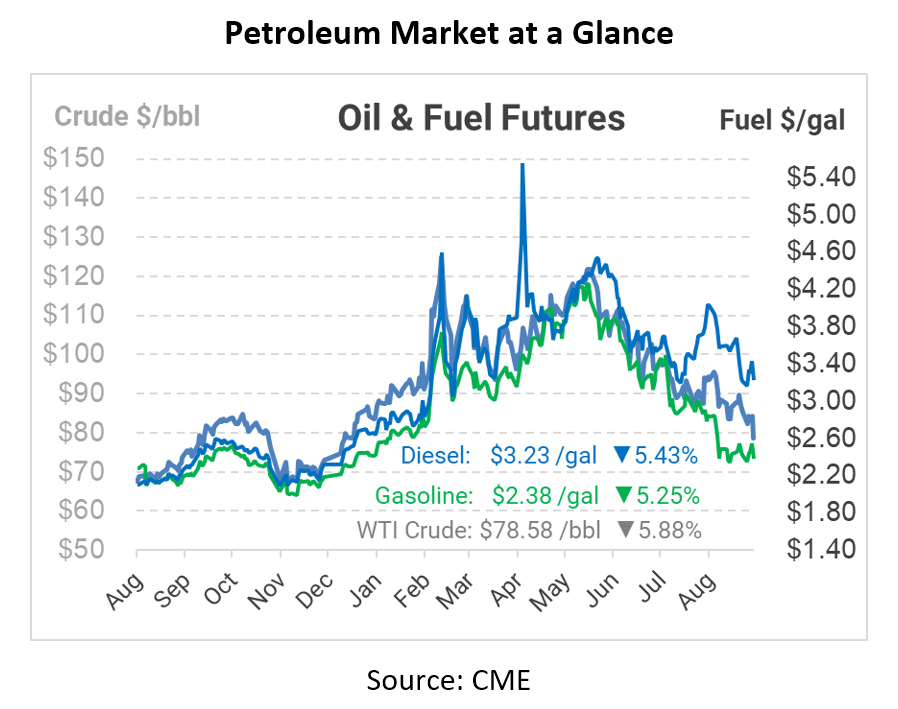

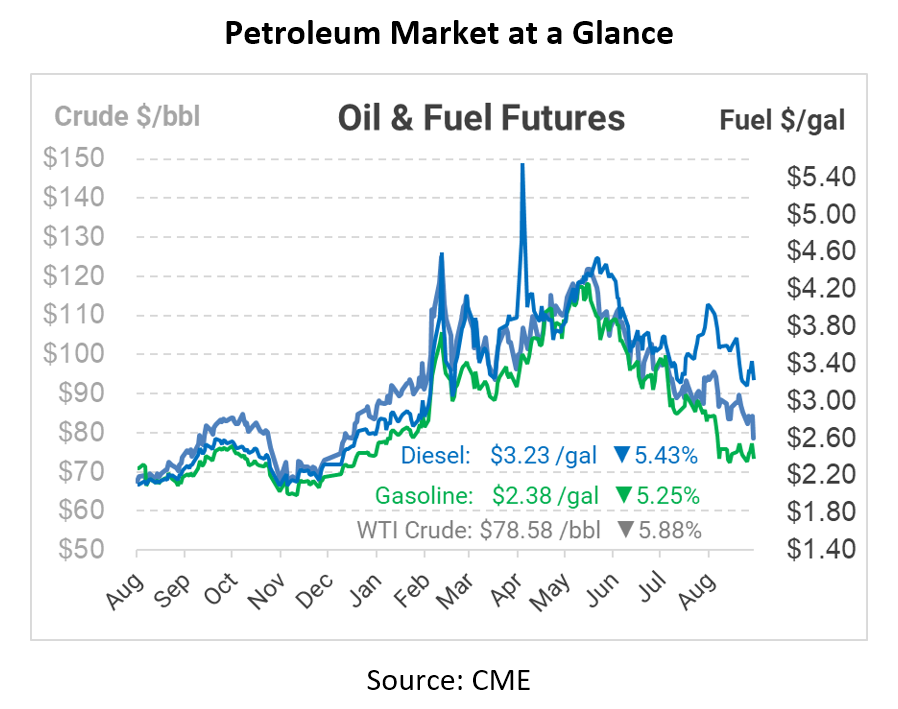

The crude oil market saw a few bullish rallies this week that tried to send prices above $85/bbl, but each rally ended with a retreat at the end of the day. Today, oil prices are sinking to their lowest levels since January, falling below the $80/bbl threshold. So what’s driving the market so far down?

A big part of the bearish pressure has to do with market finances. Rising interest rates make the US’s financial markets more appealing – investors can get higher returns on low-risk bonds. To buy bonds, international investors must first by US Dollars, driving those values higher (the dollar’s strength, relative to other currencies, is now at its highest since 2002). An improving bond market and more expensive dollar leaves less money available to flow into commodity markets, causing fuel prices to fall. This week, the Fed hiked interet rates by 0.75%, with more to come this year. Because the market knows that higher rates lead to a strong dollar and weaker commodities, they’re bidding down the market today.

This week’s EIA report added to the bearish sentiments, with across-the-board builds for fuel inventories. With recession fears mounting, the EIA’s demand data did not inspire confidence. Gasoline demand continues to show weakness, posting the lowest seasonal demand in decades. Diesel and jet fuel also seem to be trending lower. All together, the report painted the picture of tough economic times ahead.

Yet even as the market sinks lower, major banks are betting on a big oil recovery. The EU’s impending embargo on Russian oil plays a major role, as do supply challenges in various parts of the world. According to a Bloomberg article, three large banks have made the following Brent Crude projections for Q4:

- JP Morgan – $101/bbl

- Goldman Sachs – $125/bbl

- Morgan Stanley – $95/bbl

Prices in Review

This week, crude oil made a few intra-day rallies above $85, but those rallies didn’t stick. Opening Monday at $85.21, the market saw a series of ups and downs within the $82-86 range. Thursday saw a clearer trend towards the bottom of the range, and on Friday the bottom fell out of the market. Crude opened at $83.54 on Friday, a loss of $1.67 (-2.0%), but Friday’s morning moves will make the week’s losses far deeper.

Diesel prices began the week low, and climbed as time progressed. On Monday, diesel opened at $3.1878, but gained over a dime before the end of the day. Prices continued in the $3.30-$3.40 range, peaking just shy of $3.50 on Wednesday. On Friday, diesel opened at $3.4112, a gain of 22.3 cents (+7%), though trading during the day has erased nearly all of those gains.

Like diesel, gasoline also saw an upward trajectory throughout most of the weeks, only to be undone on Friday. Monday’s opening price was $2.4109, and climbed to an opening price of $2.5258 by Friday. That represents a gain of 11.5 cents (+4.8%); however, those gains have turned to losses today.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.