Natural Gas News- August 11, 2022

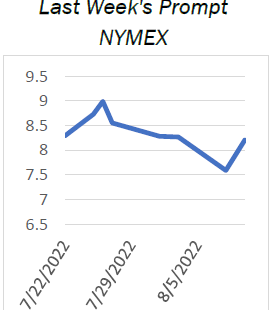

U.S. Natgas Futures Up 2% on Output Drop, Forecast for More Demand

U.S. natural gas futures rose about 2% on Tuesday on a preliminary drop

in daily output and forecasts for more demand this week than previously

expected due to an increase in pipeline exports to Mexico. That price

increase came despite forecasts for less hot weather over the next two

weeks that will reduce air conditioning use next week. Also weighing on

prices was the ongoing outage at the Freeport liquefied natural gas

(LNG) export plant in Texas, both of which leaves more gas in the United

States for utilities to inject into stockpiles for next winter.

EIA/GASNGAS/POLL Freeport LNG, the second-biggest LNG export plant

in the United States, was consuming about 2 billion cubic feet per day

(bcfd) of gas before it shut on June 8. Freeport expects to return the

facility to at least partial service in early October.… For more info go to

https://bit.ly/3bQT3QY

U.S. Natgas Output to Hit Record Highs in 2022 – EIA

U.S. natural gas production will rise to a record high in 2022, the U.S.

Energy Information Administration (EIA) said in its Short Term Energy

Outlook (STEO) on Tuesday. EIA projected dry gas production will rise to

96.59 billion cubic feet per day (bcfd) in 2022 and 100.02 bcfd in 2023

from a record 93.55 bcfd in 2021. The agency also projected gas

consumption would rise from 82.97 in 2021 to 85.16 bcfd in 2022

before sliding to 83.84 bcfd in 2023. That compares with a record

85.29 bcfd in 2019. The EIA’s latest supply projection for 2022 was

higher than its July forecast of 96.23 bcfd, while its demand projection

was lower than its July forecast of 85.85 bcfd. The agency forecast

average U.S. liquefied natural gas (LNG) exports would reach 11.16 bcfd

in 2022 and 12.68 bcfd in 2023, up… For more info go to

https://bit.ly/3bQT3QY

FEATURE: Europe’s Dash for New LNG Import Infrastructure Picks Up Pace

The scramble by countries across Europe to install new LNG import

facilities in record time continues to pick up pace, with FSRUs now

secured for deployment in a number of EU member states. The sharp

fall in Russian pipeline imports — and the prospect of flows from Russia

being cut further or halted completely — has led to plans to realize

numerous projects, both old and new, as quickly as possible. Most of the

plans are for floating LNG import facilities — known as FSRUs (floating

storage and regasification units) — which can be installed more quickly

than onshore, permanent import terminals. Some 25 new FSRUs are

expected to be installed across the EU in the coming years, according to

S&P Global Commodity Insights data, with the first facilities already

expected to be operational before the end of 2022. Proj… For more info

go to https://bit.ly/3bQT3QY

This article is part of Daily Natural Gas Newsletter

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.