US May Be in Recession – But Fuel Prices Remain Strong

The numbers are in, and GDP fell -0.9% in Q2, marking the second straight quarter of contraction. In Q1, the economy contracted by -1.6%. The typical definition of a recession is two consecutive quarters of negative growth, although there’s a variety of other statistics that play into the official declaration of a recession. Many years ago, Harry S Truman was quoted saying, “It’s a recession when your neighbor loses [their] job; it’s a depression when you lose yours.” By that definition, the strong labor market suggests we may not be in a recession at all. Whether formally labelled a recession or not, though, the numbers are clear that the US economy is going through a rough patch.

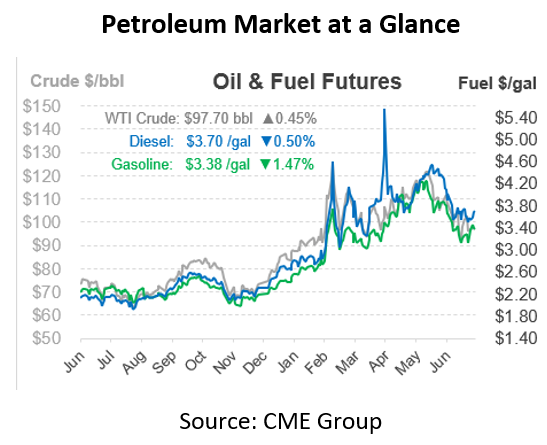

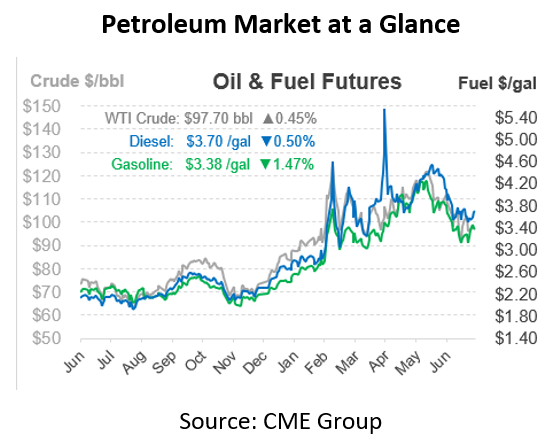

Looking at fuel markets, you wouldn’t think the economy is struggling. Following the Fed’s decision to increase interest rates by 0.75%, fuel prices rocketed upwards, with diesel up 13 cents and gasoline up 7 cents. Although interest rate hikes usually weigh on the market, traders were glad to see that the hike wasn’t the 1% increase previously forecast.

In addition, the EIA released data that showed sharp drops in petroleum inventories, Crude stocks fell by a hefty 4.5 million barrels, while gasoline and diesel fell by 3.3 and 0.8 million barrels, respectively. Gasoline demand, which has sagged over the past few weeks, rebounded to 9.2 million barrels per day – on the low end for summer demand, but not unusual. Overall, despite a weakening economy, fuel markets seem to be moving full steam ahead, keeping solid support under the market to prevent falling prices.

This article is part of Daily Market News & Insights

Tagged: crude, Daily Market News & Insights, demand, diesel, gasoline, natural gas, oil prices, prices

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.