Week in Review – July 15, 2022

This week saw yet another selloff in fuel markets, echoing last week’s drop and recovery pattern. Like last week, prices are rising once again on Friday. This time around, though, crude oil has not quite recovered the $100/bbl mark. This week brought news that inflation has climbed to 9.1% year-over-year, the highest reading in decades. The news caused traders to price in a major uptick in interest rates – as much as a full percentage increase, which would have suppressed economic growth. However, the Federal Reserve yesterday indicated their next rate hike will be 0.75%, smaller than markets expected. Markets are taking that news as bullish, with oil climbing $2/bbl since yesterday.

On the other hand, there’s plenty of news to send prices lower. This week’s EIA demand report was disappointing, showing very weak demand across all products. Gasoline in particular had a poor week – despite a holiday, gasoline demand across the US was just above 8 million barrels per day (MMbpd), far below the typical 9-10 MMbpd typically seen during the summer. With many economists calling for a recession soon, reduced fuel demand is being interpreted as a bad omen for growth.

Finally, a Bloomberg article revealed this week that Europe has become the top destination for US crude oil for the first time in six years, surpassing Asian oil demand. With Europe reducing its reliance on Russia, they’ve pivoted westward. At the same time, Asian countries are increasing their purchases of discounted Russian oil, requiring less oil from the US. The report is the latest indication of how global markets are being upended and rerouted in the face of Russia’s aggression in Ukraine.

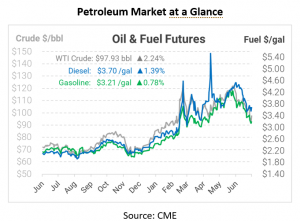

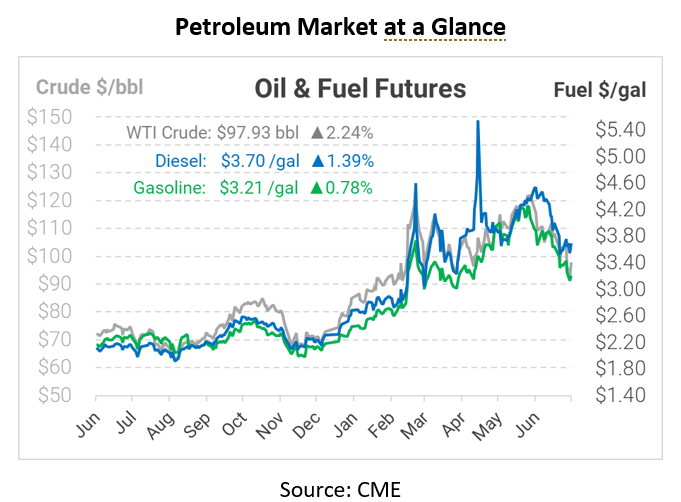

Prices in Review

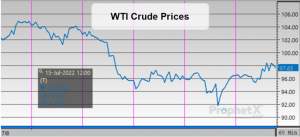

Crude oil prices began the week at $104.79, but didn’t hold that price level for long. On Tuesday, prices tumbled towards $96, where they would spend most of the week. Prices dipped even lower on Thursday before climbing higher. On Friday, crude opened at $96.39,down $8.40 for the week.

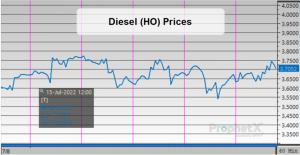

Diesel prices were a bit more steady during the week, seeing some moves up and down but not straying significantly from its starting point of $3.64. On Friday, prices opened at $3.67, a meager gain.

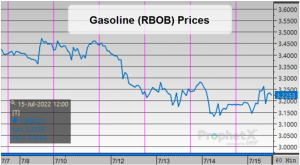

Unlike diesel, gasoline followed crude prices downward. Gasoline opened the week at $3.45, but recession fears caused an early selloff on Tuesday. When the EIA confirmed the weak demand, prices moved a bit lower. On Friday, gasoline opened at $3.19, a 26 cent loss for the week.

This article is part of Daily Market News & Insights

Tagged: Asian oil, crude, diesel, fuel markets, gasoline, Global markets, prices, Russian oil, Ukraine

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.