What Inflation Means for Diesel Prices

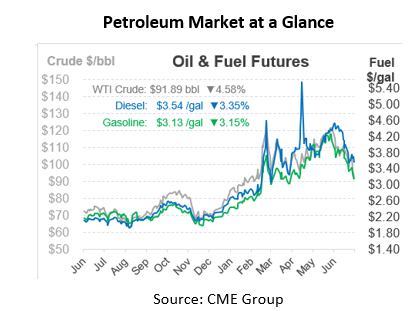

Oil markets are sliding again this morning after trading sideways yesterday. Inflation is now officially up to 9.1% year-over-year, which means higher prices for just about everything. As prices rise, consumers will have less residual income to spend on nonessentials like travel, causing fuel demand to decline. To curb inflation, the Federal Reserve will raise interest rates, making it more expensive to borrow money. Less borrowing means less demand for goods – which will help lower consumer prices but reduce business sales and economic growth.

The effects of inflation seem to be showing up in the diesel data. Yesterday the EIA reported the lowest weekly petroleum fuel demand level (18.7 million barrels per day, or MMbpd) since June 2021. Diesel demand fell to 3.5 MMbpd, compared to 4.0 MMbpd in Q3 last year. With demand falling, diesel days of supply (total fuel inventories divided by daily demand) appears to be improving, climbing from 26.9 days earlier this year to 30 days of supply this week.

Although days of supply has improved by 10%, inventories are still tight. Diesel inventories, though rising seasonally, are still well below the pre-COVID range. The US currently has 113 million barrels of diesel on hand – compared to a pre-COVID average of 140 million barrels.

What does this mean for fuel supply security and prices? Days of supply is a good indicator of the situation right now. Markets have cooled a bit thanks to inflation and weaker fuel demand. But if consumption returns to higher levels or productions falter, the equation can quickly turn ugly given low inventories. A hurricane that disrupts refining capacity or a cold winter spurring heavy diesel demand in the US and Europe could tilt the market back to an imbalance, bringing renewed price surges. Let’s hope the second half of 2022 will be less volatile than the past few years!

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.