Could the Oil Shortage Be Getting Worse?

For the past several months, Russia has been the focal point of the energy crisis. Russia is the world’s third-largest oil producer, so it makes sense that western energy sanctions on Russia would severely impact oil and other energy commodities. And because energy is a global market, it’s no surprise that high oil prices have rippled worldwide, even to places like the US and Canada that are not dependent on Russian imports. While Russia remains in the spotlight, oil markets are now expanding their focus to production challenges in other countries that could further degrade global supplies.

Many of the world’s major exporting countries also face domestic political instability. Over the past several decades, coups and military uprisings have triggered market volatility. It’s unsurprising that high prices and inflation – combined with record government surpluses for corrupt producing countries – are causing unrest. In Libya, a country that has suffered numerous outages in recent years, political upheaval has brought the country to the brink of declaring force majeure on exports from its major eastern terminals. The country has already seen its output slide to roughly half of its 1.2 million barrel per day capacity, making continued exports challenging.

In Ecuador, a country that normally produces around 520 thousand barrels per day, anti-government protests are threatening a complete shutdown of oil production. Their Energy Ministry has reported that “vandalism, takeover of wells, and closing of roads” are preventing normal operations. Production has already been cut in half, with a complete shutdown possible in the coming days.

For months, markets have looked to OPEC for relief. Although the cartel did not rapidly respond to higher prices, they did continue hiking output each month. Now, OPEC’s major producers – Saudi Arabia and the UAE – appear to be maxed out on their spare capacity. Normally, Libyan or Ecuadorian outages would simply be covered by increased production from the Saudis or the UAE, but now there’s less slack in the supply chain. At a recent global summit, global leaders noted that the UAE is currently at maximum capacity, while Saudi Arabia has a meager 125 thousand barrels per day of spare capacity remaining.

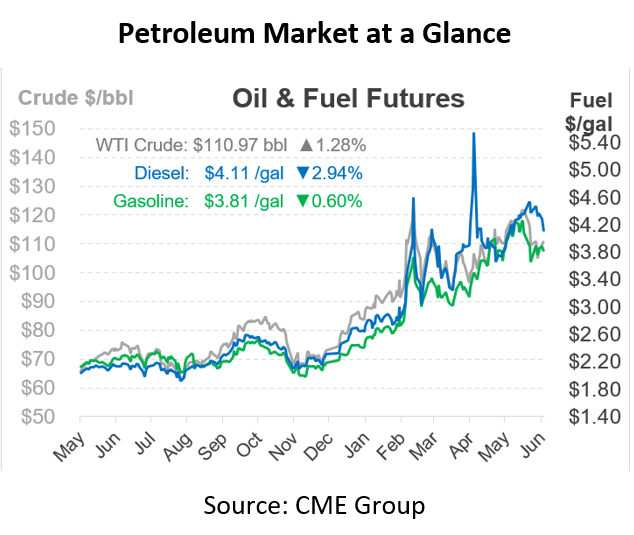

What does all this mean for North American fuel prices? Crude oil has pulled back from its recent peak in the $120s range, but prices could quickly spring back up to that level and beyond as global production is curtailed. Unless the world can find new supplies or bring Russian aggression to a speedy end, supplies will continue tightening. The alternative is demand destruction, likely in the form of a recession, to balance the supply/demand equation. Either way, fuel buyers are in for bumpy roads ahead.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.