OPEC+ Deal Briefly Drops Prices

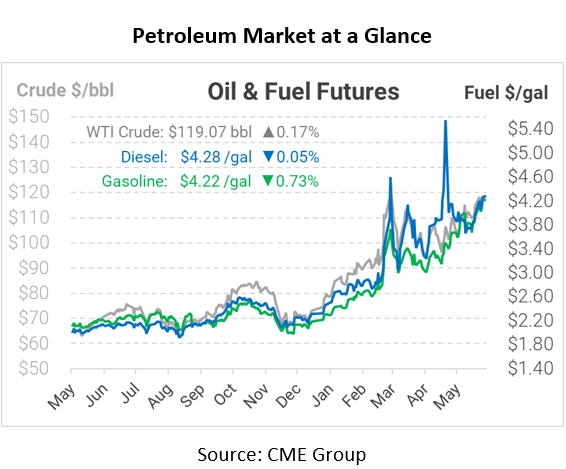

This morning crude prices are slightly up and hovering around the $120/bbl mark after falling following an OPEC+ supply deal. This deal saw Saudi Arabia raise their July prices after continued supply disruptions are still evident due to the Russian conflict in the East.

Before the Saudis initiated this price increase, OPEC+ decided last week to boost their output for July and August by a total of 648,000 barrels per day. This increase was more than 50% of what was previously planned, impacting all OPEC+ members. The increase is also expected to offset some of Russia’s decline due to sanctions. One concern is that many of these countries have little room to increase their output, but OPEC+ is sticking with the current plan. These doubts about reaching the new output level caused crude oil to retreat from the $120 mark this morning before climbing slowly shortly after.

In the United States, today’s national average price of gasoline reached $4.87, up 25 cents in the past week and a staggering 59 cents in the last month. Slowly increasing, there are now ten states in the country that have average gasoline prices well over $5, including Washington, DC. According to new data from AAA, Georgia is the only state with an average gasoline price below $4.30. Oil analysts suggest that gasoline prices will top $5.05/gallon in the next ten days as prices continue to rise. With gasoline rising alongside crude as supply has failed to keep up, many are now turning their hope toward the OPEC+ increase to see if it can spark a new course for prices.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.