No Stopping the Oil Rally? This Week in Review

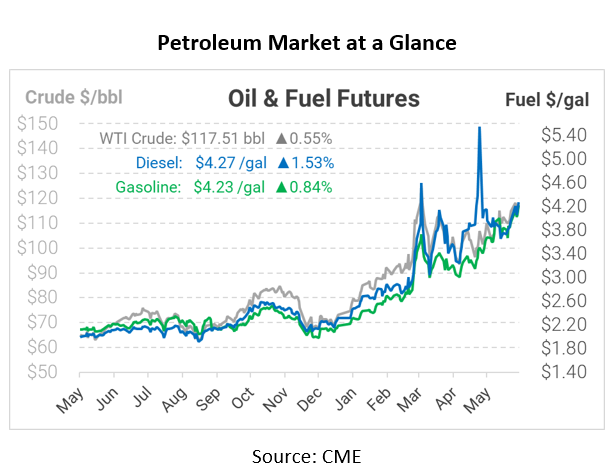

Looking back at this past week, the upward rally for oil prices has been relentless despite some bearish news this week. Although some days have begun lower, prices have risen the past three straight trading sessions – and today looks to continue that streak. As always, there are a few factors on both sides impacting the fuel market, so let’s review what’s been driving the market this week.

Bullish

EU bans 90% of Russian oil. On Monday, the EU agreed to ban up to 90% of Russian oil by the end of the year, focusing on seaborne oil shipments while excluding pipeline shipments. Although companies have until December to stop crude oil imports and until January for refined fuel imports, analysts expect an immediate drop in imports, followed by a continued transition over the next six months. The sanctions also target insurance for oil tankers – and since Europe dominates the insurance business for global tankers, the disruption could prevent some Russian tankers from moving to Europe or Asia until new insurers are found.

China lifts COVID lockdowns. After two months of restrictive lockdowns, China has finally lifted its COVID restrictions in Shanghai, its financial hub. As the world’s largest oil importer, the lockdowns severely hampered demand outlooks. With China set to return to normal, analysts expect a big fuel demand uptick to drive higher prices.

US crude inventories fall 5 million barrels. This week, the EIA reported that crude inventories fell 5 million barrels per day, while diesel and gasoline each posted slight drops. Fuel inventories are the key indicator for supply balance – rising supplies mean markets are improving while falling stocks show tight and worsening supply.

Bearish

Economic concerns rise. Labeled by one news source as “good news is bad news”, this morning’s jobs report showed more jobs being created in the US, with continued low unemployment. Although good for workers, continued job growth will fuel more inflation, which has seen 40-yr highs and 8%+ growth in March and April. Higher prices will ultimately translate to less spending, weakening the economy and fuel demand.

OPEC commits to increased supply. OPEC+ agreed to raise supply in July and August by 632 thousand barrels per day (kbpd), a 50% increase from their typical 400 kbpd increase. The group was set to restore all production by September; now, they’ll have unwound their cuts by August. Still, many countries are facing technological and supply chain challenges preventing them from ramping up output, so the notable increase may be more symbolic than substantive.

Prices in Review

This week saw prices generally angling higher throughout the week. Across the board, oil and refined products saw a steep increase during Monday’s off-hours holiday trading due to the EU ban on Russian oil. Prices held steady on Tuesday, falling a bit on Wednesday/Thursday morning but ending each trading session with new 3-month highs. This morning, prices continue to climb higher, with diesel up 6.5 cents, gasoline up 3.5 cents, and crude barrels up 60 cents.

Crude Oil:

Diesel:

Gasoline:

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.