Record Gas Prices Hit Pumps

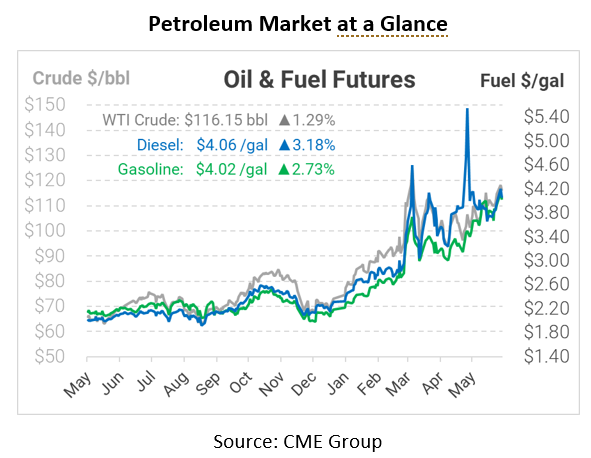

This morning oil prices are up slightly following the continued reaction to the Russian oil ban as well as China ending its Shanghai COVID-19 lockdowns. To make matters worse for consumers, average national gasoline prices have reached a new record-high, causing more pain at the pump as summer driving season has arrived.

According to AAA this morning, gasoline prices took a massive step backward as a new record-high was reached at $4.671/gallon. This is a new record, surpassing the $4.62 record hit on Monday. Gasoline was up five cents more than Tuesday, and a total increase of 48 cents in the last month alone. It now costs around 32% more to fill up your car’s tank today than it did before Russia invaded Ukraine. With over seven states averaging above $5 and all states surpassing the $4.15 average mark, many analysts are now suggesting that Americans should be ready for a $4.75 average in the next 10 days.

So far, demand has remained subdued, but analysts will be watching tomorrow’s EIA data for clues on how the long weekend will effect prices. Last week, the EIA showed demand steady in the 8.7 to 9.0 MMbpd range; during peak summer demand, that number could be some 5-10% higher. More gasoline demand means refiners focusing their efforts towards gasoline and away from diesel, while fuel truckers pivot more of their fleets to delivering retail gasoline. For diesel buyers, summer gasoline demand can make diesel supplies and logistics more challenging.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.