EIA: Stronger US Dollar Contributes to Higher Crude Oil Prices

Source: EIA’s Today in Energy, May 17

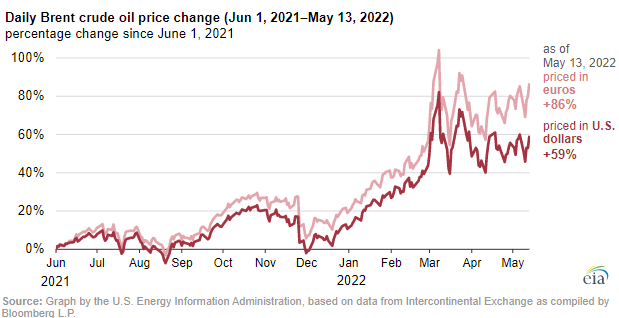

The price of Brent crude oil, the world benchmark, has increased in 2022, partly as a result of Russia’s full-scale invasion of Ukraine. In addition, a strong U.S. dollar means that countries that use currencies other than the U.S. dollar pay more as crude oil prices increase. Since June 1, 2021, the Brent crude oil price has increased by 59% in U.S. dollars and by 86% in euros.

The U.S. dollar index measures the value of the U.S. dollar against six currencies: the euro, yen, British pound, Canadian dollar, Swiss franc, and Swedish krona. When the U.S. dollar index increases, it means the U.S. dollar is gaining value against those currencies. Conversely, it also means those other currencies are losing value against the U.S. dollar.

Crude oil is generally priced in U.S. dollars, so purchases in other currencies are not only affected by the dollar price of crude oil but also by the exchange rate to the dollar. The price of crude oil and the value of the dollar generally move in opposite directions so these factors offset each other. Recently, however, the price of Brent crude oil and the value of the U.S. dollar have both increased.

Recent increases in short-term U.S. treasury yields may be contributing to higher demand for U.S. government bonds, which increases demand for U.S. dollars and, therefore, the value of the U.S. dollar against other currencies.

The value of the U.S. dollar also increases when it is considered a safer investment compared with other currencies. Recent global events, including Russia’s full-scale invasion of Ukraine and concerns caused by COVID-19 mobility restrictions in China, may also be increasing demand for the U.S. dollar.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.