Diesel Supplies Rise, but JP Morgan Now Forecasting $6 Gasoline

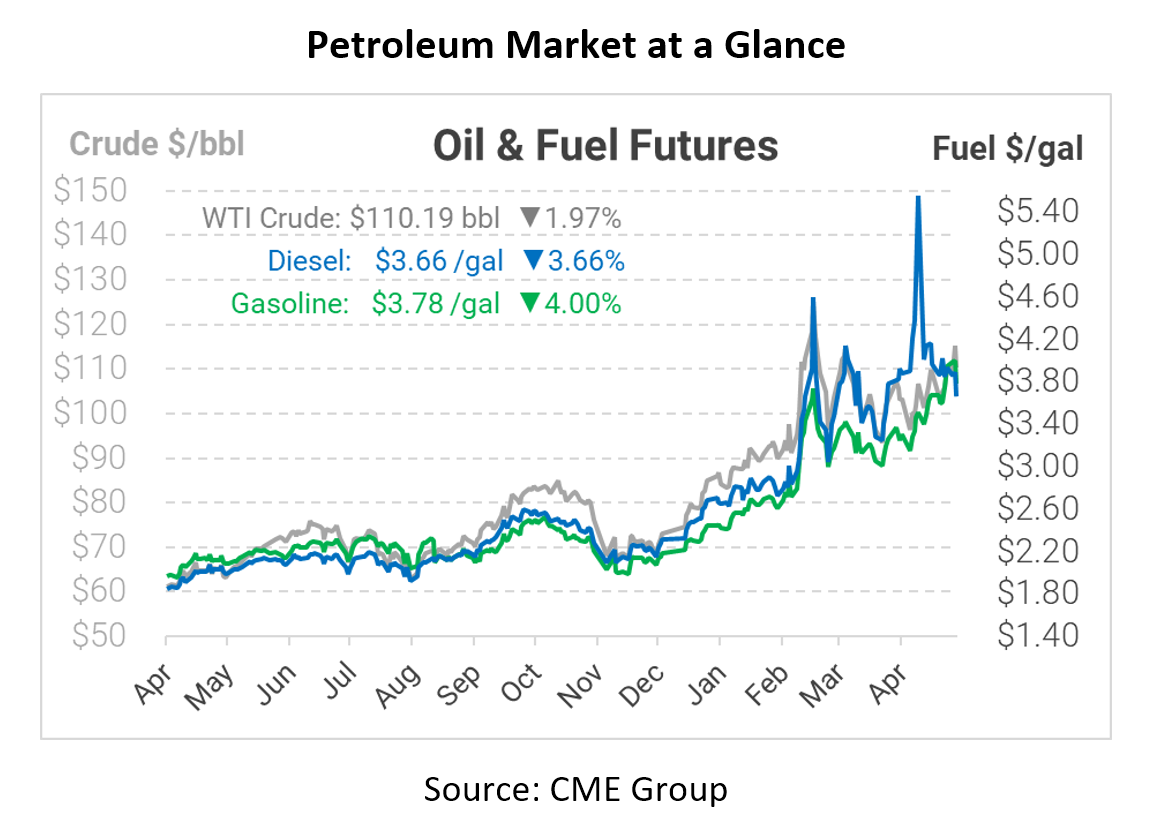

This morning the EIA reported a meager 1.2-MMbbl build for diesel inventories – a small victory given historically low diesel inventories. Oil markets appear to be celebrating the news this morning, with fuel prices down roughly 15 cents following the morning report. Both gasoline and diesel have moved away from the $4/gal threshold, though a quick spike to $4 remains quite possible given recent volatility.

Despite the market’s sigh of relief over diesel inventories, the EIA’s report was far from bearish. Crude inventories fell by 3.4 million barrels, and gasoline fell 4.8 million barrels. Gasoline inventories are at the low end of their historical range, and further draws are expected throughout the summer during peak summer demand season. JP Morgan warned yesterday that retail prices could rise as high as $6/gal nationwide, though other analysts say demand destruction would kick in well before prices rise that high.

Peak summer gasoline demand typically begins with Memorial Day and lasts through Labor Day. This week, gasoline demand rose above 9 million barrels per day for the first time since March. Although the level is a bit behind pre-COVID levels, it’s in line with 2021 averages. Last year, summer demand averaged 9.4 MMbpd – meaning refiners will have to figure out how to add another 400 kbpd (16.8 million gallons) of output or pull that from inventories. Assuming all of that comes from inventories, stocks could fall by 36 million barrels to 184 million barrels – the lowest level since October 2008.

It’s a bleak picture for gasoline – either prices will skyrocket this summer, or a recession will break demand and keep prices lower. Neither option is particularly appealing.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.