Oil Hits 2-Wk Low on Chinese Lockdowns

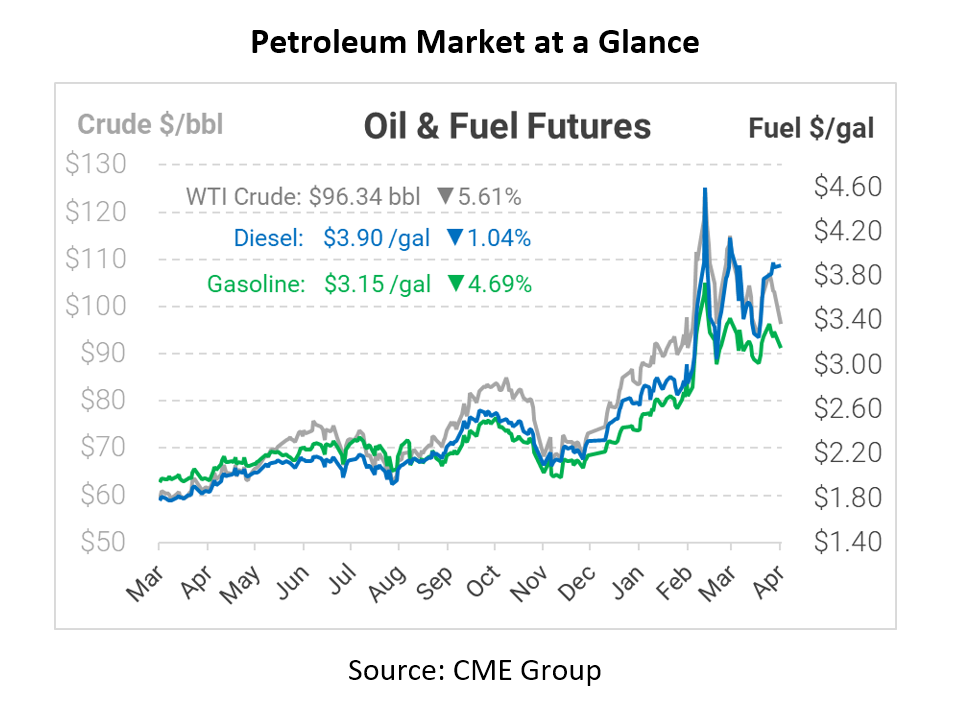

This morning crude oil is down significantly as the major city of Shanghai continues its lockdowns, prompting many fears about demand in the region. Residents in Beijing are preparing in case lockdowns occur in their city, demonstrating how concerns can spread. Lockdowns in China, paired with interest rate increases in the U.S., have investors worried about demand, prompting the selloff this morning. Crude oil opened at $101.38, diesel at $3.9544, and gasoline at $3.2986.

In Shanghai, the world’s fifth-largest city, conditions are deteriorating as the government attempts to reign in new COVID cases. Images of buildings with newly erected fences around them are becoming mainstream, and many stores are out of essentials, including food. Almost all people living in the city have been confined to their homes, with few chances to leave. As China is the second-largest oil consumer in the world behind the United States, lockdowns will reduce oil demand. China’s government seems not to be loosening up on the restrictions in Shanghai and other cities, instead making them stricter to curb disease spread.

Amid all of the market’s chaos, the U.S. has now added more rigs for a fifth straight week. With the ongoing conflict in Ukraine, European countries are also in the process of imposing “smart sanctions” against Russian oil imports, maximizing pain to Russia while minimizing pain to the West. Analysts expect these “smart” sanctions could include a phased decrease or a tariff on Russian oil. Of course, any policy that reduces Russian exports will hurt global supply markets unless those exports are re-routed to another destination. This has occurred in some places, but countries like China and India don’t have the infrastructure to receive increased Russian product even if they may want to buy it. With that in mind, any sanctions applied to Russia will still have a painful effect on global fuel prices, no matter how “smart.”

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.