Oil CEOs Will Testify Before Congress

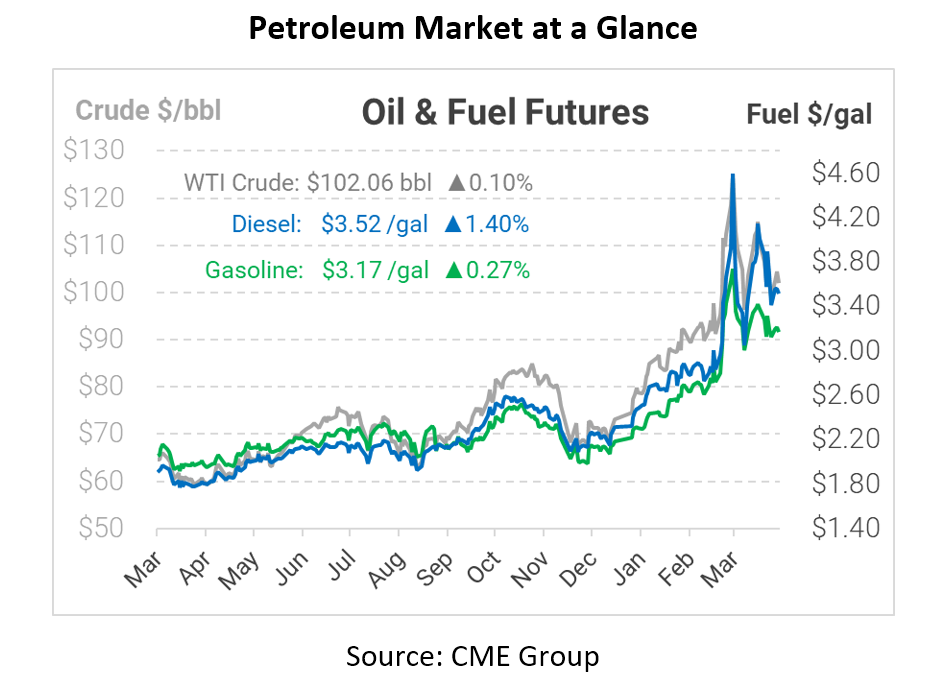

Today oil prices are up slightly again as new Russian oil sanctions are moving full steam ahead, worrying consumers that prices may go even higher in the future. High prices have been at the top of everyone’s mind, from oil traders to politicians to regular consumers. As the supply crunch rages on, CEOs from six major oil companies are heading to Congress to testify over what’s driving prices.

Amid a highly polarized Congress, the CEOs have their work cut out for them. These leaders are set to take on questions from lawmakers from the House Energy and Commerce Subcommittee on Oversight and Investigations. Often, conversations like these turn into an opportunity for political posturing, but what if there’s a more productive dialog? It may not be as helpful as you’d think.

Although politicians on both sides of the aisle try to pin today’s high prices on “big oil greed” or “excessive regulations”, most oil and gas companies are facing a different challenge: Wall Street. After years of booms and busts causing bankruptcies, investors are pushing oil companies to avoid the “boom” as a way to avoid the eventual bust. Oil and gas companies are in turn focusing on delivering cash flow from existing wells, rather than growing whenever prices rise. This pressure is creating real problems for oil prices since the world needs more American oil. But the answer may not be solved in one Congressional hearing.

One of the reasons these oil leaders will testify is due to the fact that the answer is more complex than two arguments on the political spectrum. Patrick De Haan, head of Petroleum Analysis at GasBuddy, said “the reasons behind the cost of gas are more complex than any one of those narratives suggests”. Inviting these oil executives to testify will help clarify the situation the world faces more concretely, but it will not provide any more relief to the current market until action is taken.

This article is part of Daily Market News & Insights

Tagged: CEO, oil executives, oil giants, sanctions

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.