Prices Rise on EU Chill, Positive COVID Data

Oil prices are rising once more this morning, regaining some steam thanks to the EIA’s inventory report. Of course, Omicron concerns are weighing on markets, but the planned distribution of 500 million test kits is providing support. While the test kits on their own won’t impact demand, it does seem to be the Biden administration’s way of avoiding lockdowns. Reports from South Africa now show that Omicron results in 80% fewer hospitalizations. Adding to favorable news, the UK announced it will not be imposing any further lockdowns during the busy holiday season.

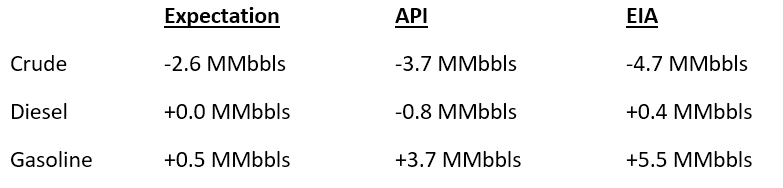

The EIA’s inventory report provided mixed direction this week. Although crude inventories fell more than expected, fuel inventories rose even faster. In particular, gasoline posted a huge 5.5 million barrel build, suggesting an oversupply of the consumer fuel. It’s normal to see a big gain in gasoline inventories this time of year, along with a dip in gasoline demand before the big holiday weekend. Diesel demand was also down sharply, with a 1.1 million barrel per day drop.

Earlier this year, many publications pointed to the possibility of European fuel switching – power plants shifting from natural gas and coal consumption to oil consumption. A severe patch of winter weather is causing that to happen this week, with energy prices soaring to record highs. Several oil-consuming plants kicked on, increasing fuel demand and causing prices to rise globally.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.