3 Bearish Trends Today Push Prices Down

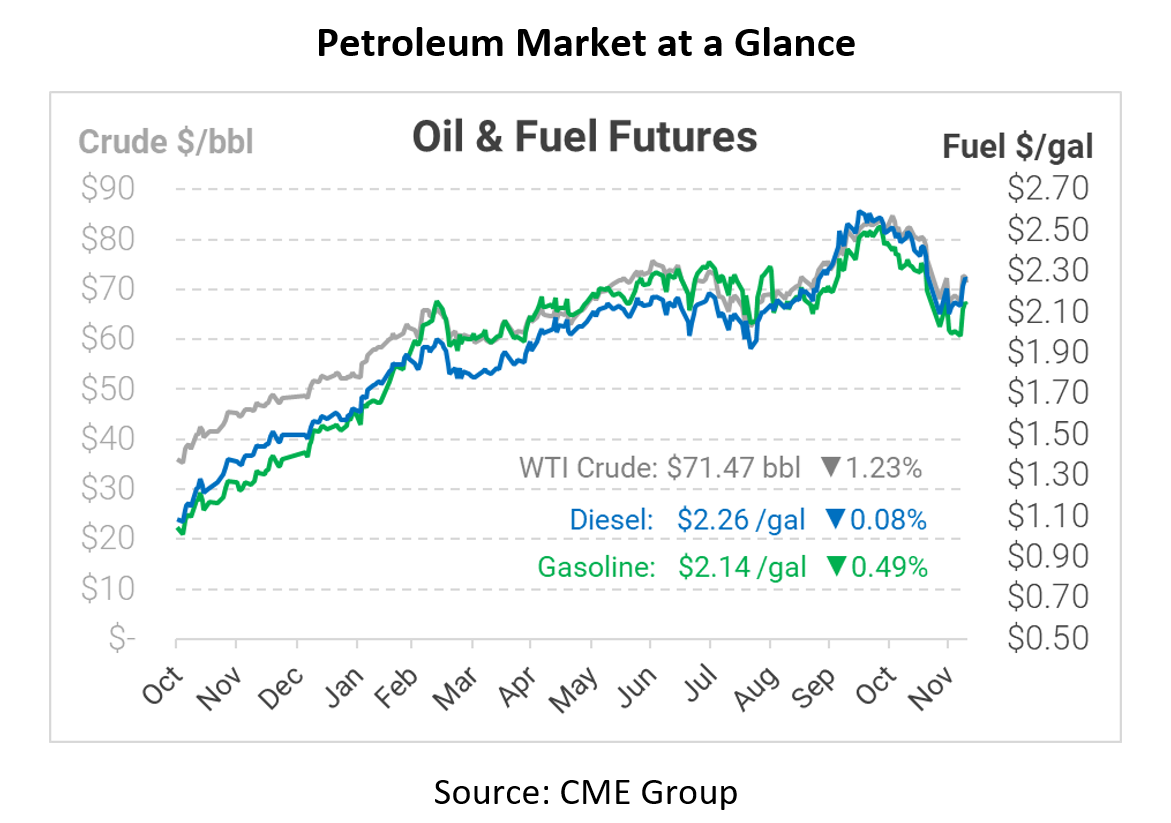

The Omicron variant is once again affecting fuel prices this morning. England, Denmark, and China imposed new restrictions to curb the spread of Omicron. Some countries are facing rising case rates, causing fear that more restrictions could come in the future. On a more positive note, the Pfizer vaccine has been reported to be effective against Omicron, providing relief against spreading infections. Fuel markets are turning back a bit, though crude oil remains above the $70 mark.

Adding to bearish sentiment, two Chinese real estate companies went through a rating downgrade, indicating China’s decaying economic growth. One of the companies, Evergrande, has already been in the news this year due to default fears. Now, that company has defaulted on nearly $1.2 billion of foreign debt. Analysts have compared the shake-up to US bank failures in 2008, causing discomfort for traders. For oil traders specifically, China is the world’s largest oil importer, so even a minor economic blip can have severe repercussions for global fuel demand.

Looking at near-term fundamentals, the EIA released their weekly report yesterday, which also showed some bearish numbers. Although the market expected a solid draw from crude inventories, they fell by just 0.2 million barrels. At the same time, diesel and gasoline inventories rose by 2.7 MMbbls and 3.9 MMbbls, respectively. Fuel builds are seasonally normal – refiners have mostly completed their maintenance turnarounds and demand is lower.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.