Stuck in Traffic? More Traffic, Growing Demand, Higher Prices

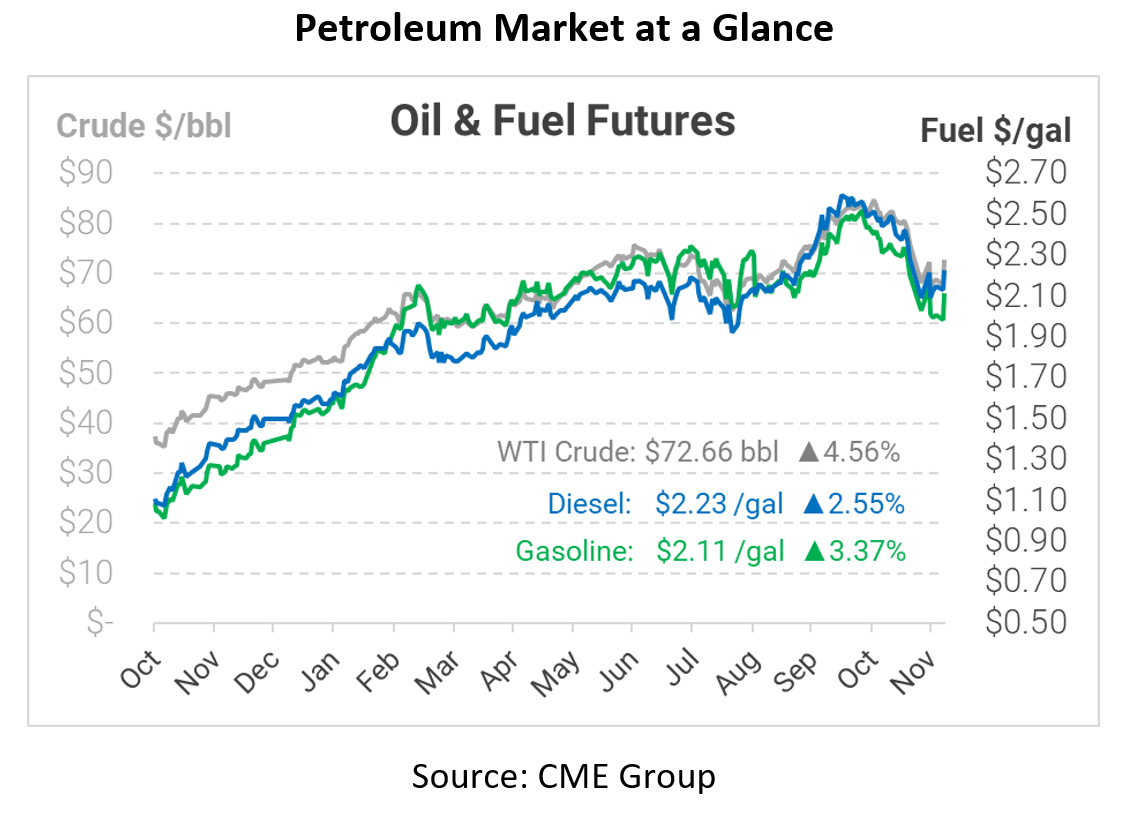

Markets are rebounding, slowly but surely, to pre-selloff levels. WTI crude is once again above $70/bbl, up from a low of $65/bbl a week ago. Last week’s dip saw investors sell the equivalent of 130 million barrels of oil during the week, according to CFTC data. With attention shifting away from the seemingly mild Omicron variant, traders are looking around for other clues on the global supply environment. Or at least, they would if they weren’t all stuck in traffic.

If you’ve travelled pretty much anywhere lately, you’ve experienced increased congestion on the roads. A recent report reveals that travelers lost 36 hours to road congestion this year – up from 2020 but still just one third of pre-COVID traffic. With many workers still working remotely, drivers are spending less time on the road – yet when they do leave, roads have been quite congested. Unsurprisingly, Chicago, New York, and Philadelphia experienced the worst traffic. The report also lists the most congested routes in the US, with LA’s I-5 and New York’s Brooklyn Queens Expressway taking the top two spots.

This week at the World Petroleum Congress, an international oil industry conference in Houston, oil majors declared the importance of fossil fuels to the global economy, warning of the dangers of underinvestment. Amin Naser, CEO of Saudi Aramco, noted that oil and gas must have a place in the energy transition, adding, “admitting this reality will be far easier than dealing with energy insecurity, rampant inflation and social unrest as the prices become intolerably high, and seeing net-zero commitments by countries start to unravel.” Although the energy transition is necessary and important, the transition will take decades. Focusing on curtailing fuel consumption, rather than on making existing consumption more efficient, may ultimately make the transition harder, not easier.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.