Prices Rise as OPEC+ Decision Awaits

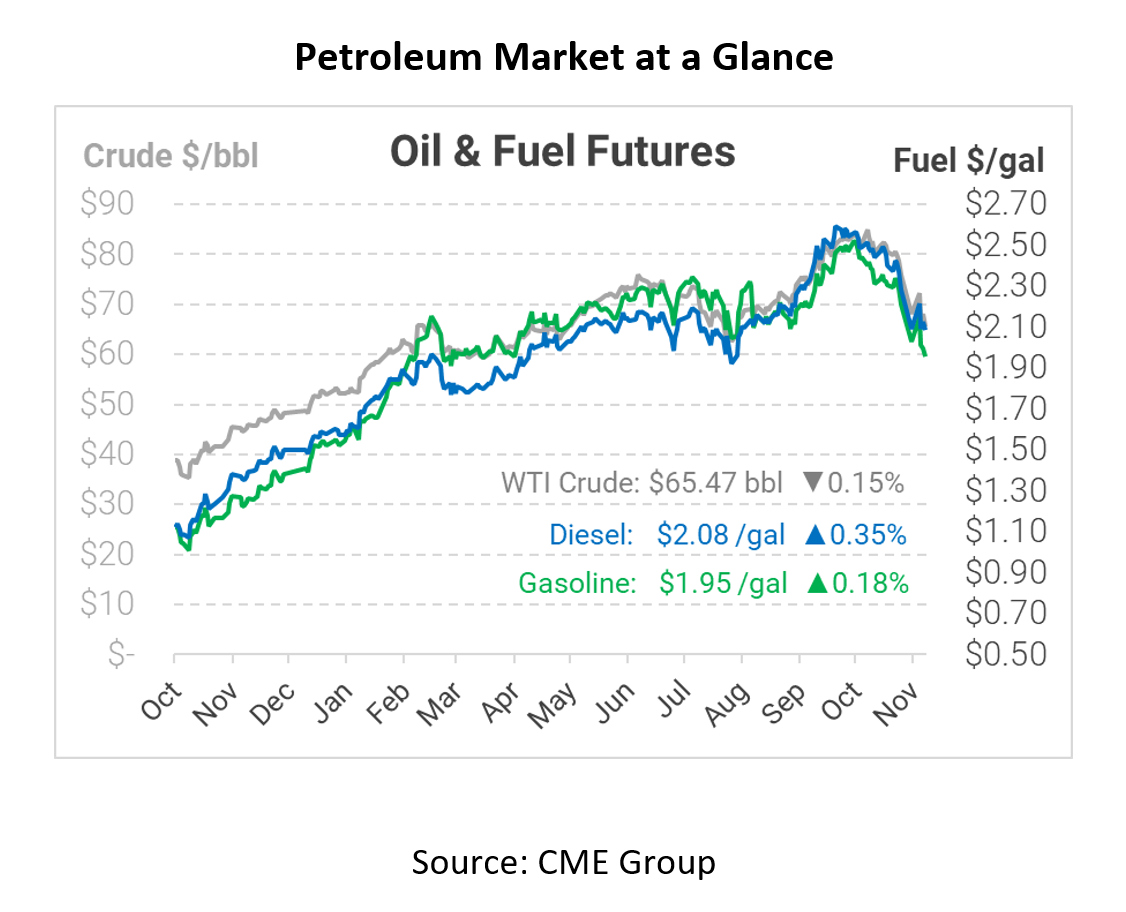

With the new Omicron COVID-19 variant hitting mainstream media, as well as fears about what OPEC+ will decide on supply policy, consumers are taking a hit this morning with oil prices rising. Simply put, Omicron is impacting demand, and OPEC+ is responding to changing demand by changing their supply plan. This morning crude oil opened at $65.63, diesel at $2.0725, and gasoline at $1.9525.

The first time prices started to reflect the new variant came last week when global oil prices started to take a hit. Since then, global prices have lost over $10 a barrel. With the first known case of the Omicron variant hitting the mainland United States yesterday, the next week will be important to track as cases will likely rise, resulting in extreme market activity. But the Omicron variant is not the only event to which investors are paying close attention.

Today OPEC+ meets to discuss the possibly of either releasing more oil into the market or pulling back supply. The output amount of 400,000 bpd added to global supply per month has not changed since August. Even though there are talks that they could increase output, many analysts suggest such an increase will not happen. Jeffrey Halley, a senior market analyst at OANDA said, “the collapse in oil prices and uncertainties surrounding Omicron will prompt OPEC+ to call a temporary halt to production increases”. If true, oil supply would be strained for an unknown period of time across the world.

One thing to watch over the next week will be the Biden White House and any action they may take regarding an OPEC+ decision. Some suggest that the White House could adjust the timing of the planned strategic petroleum release that they have initiated in order to help curb the price impact of a potential OPEC+ halt to production increases.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.