Buy the Dip? Why the Omicron Panic May Be an Opportunity

Possibly the greatest investor of all time, Warren Buffet, is famous for his line: Be greedy when others are fearful, and fearful when others are greedy.

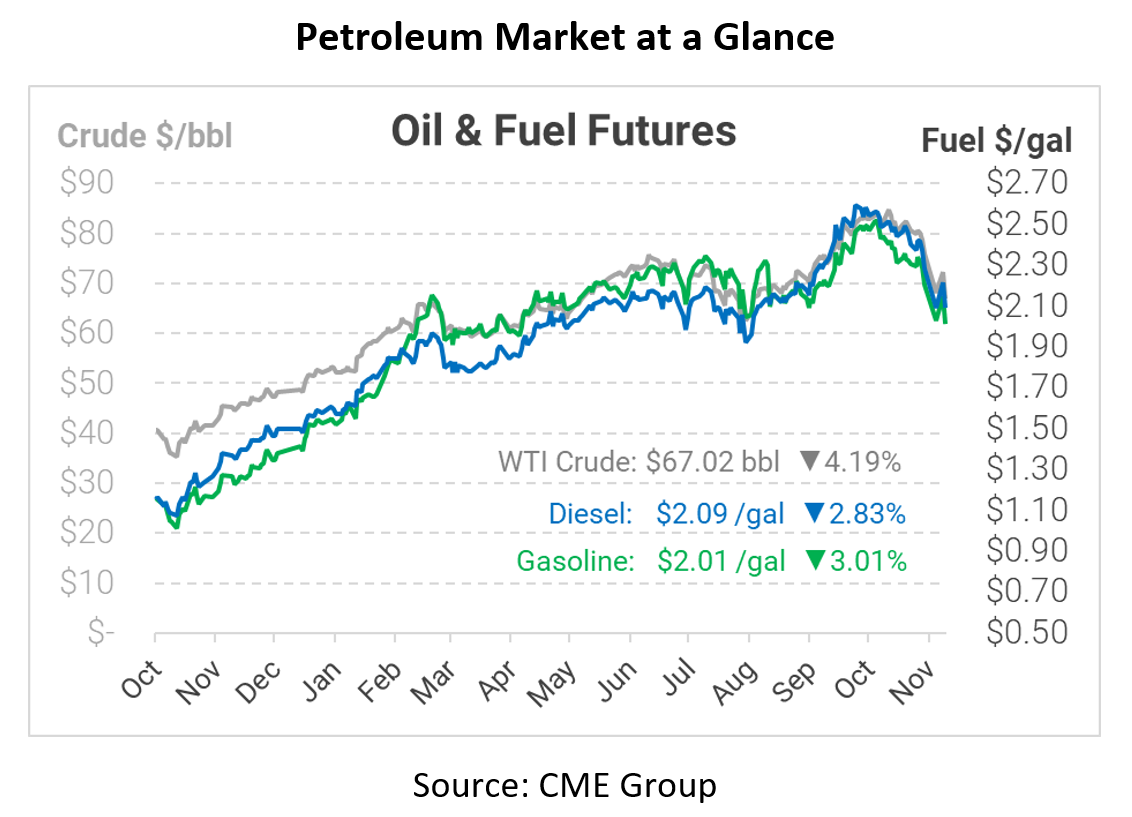

With Omicron causing a panic and a 30+ cent dip, now may be a great time to consider locking in a fixed fuel contract while the market is fearful. Today, we’ll look at the long-term fuel price outlook, the recent dip, and how likely Omicron really is to substantially impact oil prices.

Long-Term Fuel Prices

As oil markets were plummeting, JP Morgan released a new research article stating that $5 retail gas is not merely possible next year, it’s likely. The report points out that OPEC+ has far less ability to increase oil output than currently thought by the market. Their member countries are constrained by poor infrastructure and lack of investment. Put another way, those countries are struggling with the same supply chain constraints facing the rest of the world.

The report highlights that the world has a $750 billion underinvestment in oil right now, meaning future capacity will be severely strained. There are several reasons for the underinvestment – fear caused by COVID last year, the popularity of green energy, financial restraint, supply chain issues, and more. JP Morgan estimates that oil will need to trade above $80 per barrel in 2022 to incentivize that investment, spiking as high as $150 at some points.

Other oil forecasters have set their 2022 forecast around $70-$80/bbl, with prices moving higher and lower throughout the year. It’s clear that supply is tight, and demand will likely continue rising, excluding any surprise infection issues – which we’ll discuss in the next section.

The Dip

Omicron is a big unknown right now, so the market is reacting to a worst-case scenario. The CEO of Moderna hinted that the virus may be more vaccine-resistant than other strains, though he also noted that plans were underway to produce and distribute a booster targeting the new variant. On the flip side, the BioNTech founder said it’s unlikely to cause severe illness in vaccinated individuals.

The biggest challenge with Omicron is that it has a number of mutations – combining some of the worst mutations from previous variants to make itself more transmissible, more vaccine-resistant, and more persistent. Pharmaceutical companies are experimenting on the virus and will have more information in the coming weeks.

The Omicron variant has popped up in various countries worldwide, so it’s too late to contain it just in South Africa. Pandemic fatigue will make it a challenging ordeal for countries to reimpose lockdowns, so we may see a lighter version of the restrictions seen in 2020 until health organizations can get a grasp on the virus.

More likely, vaccines will still have some effect against Omicron, but at reduced efficacy rates. Pfizer and Moderna have both announced that a variant-specific strain could be manufactured and ready for distribution by Q1 2022, so any lockdowns would be temporary.

What does all this mean for fuel prices? It’s possible that prices could dip somewhat in the short-term as some countries introduce lockdown measures, but those should prove temporary. Moreover, OPEC+ producers have struggled to get production as high as it is, so they could respond by skipping the next supply hike – or even reducing supply a bit.

Overall, the short-term panic seems overstated. Even if demand falls a bit, OPEC+ will gladly cut their supply to make sure oil prices remain in balance.

So What Next?

No one knows what the future holds. Another mutation in 2022 could prove more worrisome than Omicron and cause prices to plummet. Demand could keep rising as OPEC+ keeps supply steady, causing prices to rise steadily. Or an infrastructure problem in Saudi Arabia or Russia could cause prices to suddenly skyrocket.

Nothing is known about the future, which is why it’s important to have a risk management strategy for all occasions. Can you be confident that you’ll hit your fuel budget, even if prices soar.

Consider a fixed fuel price. You can select the plan that works for you – one set price for the entire year, a collar that keeps your prices in a predictable range, or a cap that lets you pay market prices while knowing you’ll never pay more than a set maximum.

Diesel prices were above $2.40 just two weeks ago and now are less than $2.10. If JP Morgan is correct that prices could hit $5/gal next year, now may be an opportunity to buy the dip and lock in a low rate for all of 2022.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.