Better Days Ahead? IEA Suggests Prices Could Improve

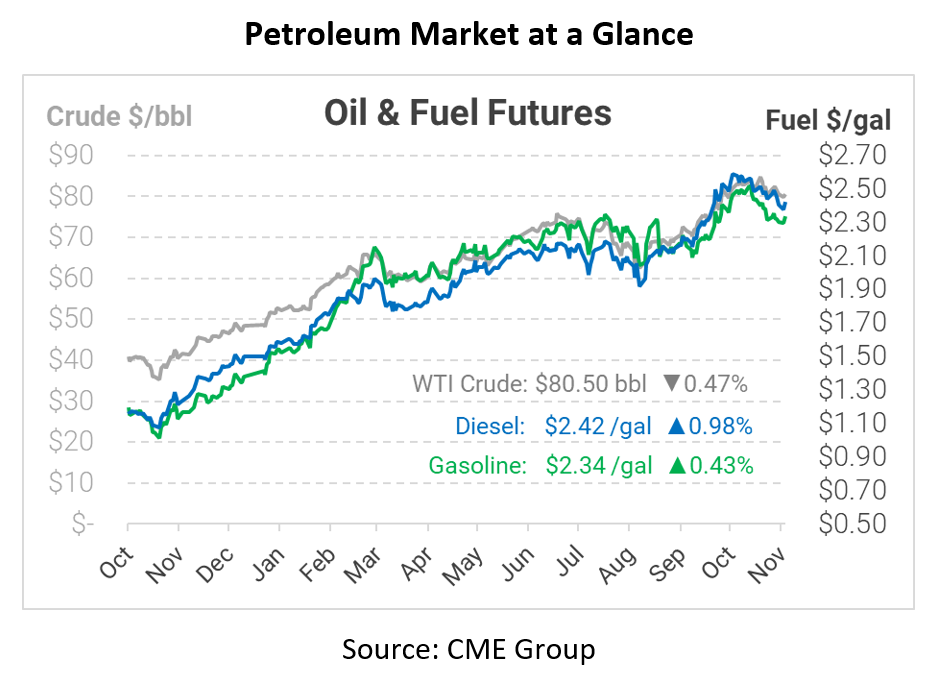

The oil price rally has been relentless, but in their recent monthly report, the IEA noted that the tides may be turning. Their report notes, “The world oil market remains tight by all measures, but a reprieve from the price rally could be on the horizon.” Although demand is rising quickly, oil supplies have been rising just as quickly, including the US’s post-hurricane rebound. Next year, US production will account for 60% of annual supply increases, assuming OPEC+ sticks to current plans.

From an inventory standpoint, the report noted that OECD inventories – representing fuel stocks in developed economies – fell in September, taking them to their lowest level since 2015 and 250 million barrels below the five-year average. They do hint that inventories may have loosened in October, though final data is still pending.

On the other hand, increased US spending could suggest increased demand in the future. Although President Biden’s $1 trillion infrastructure package is considered to support clean energy, in reality the construction and repairs will be done by fuel-consuming heavy equipment. It’s unclear exactly how much demand will change, but items such as “carbon offsets” allow the bill to be cleaner while still increasing fuel consumption.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.