OPEC+ Declines US Calls for Help

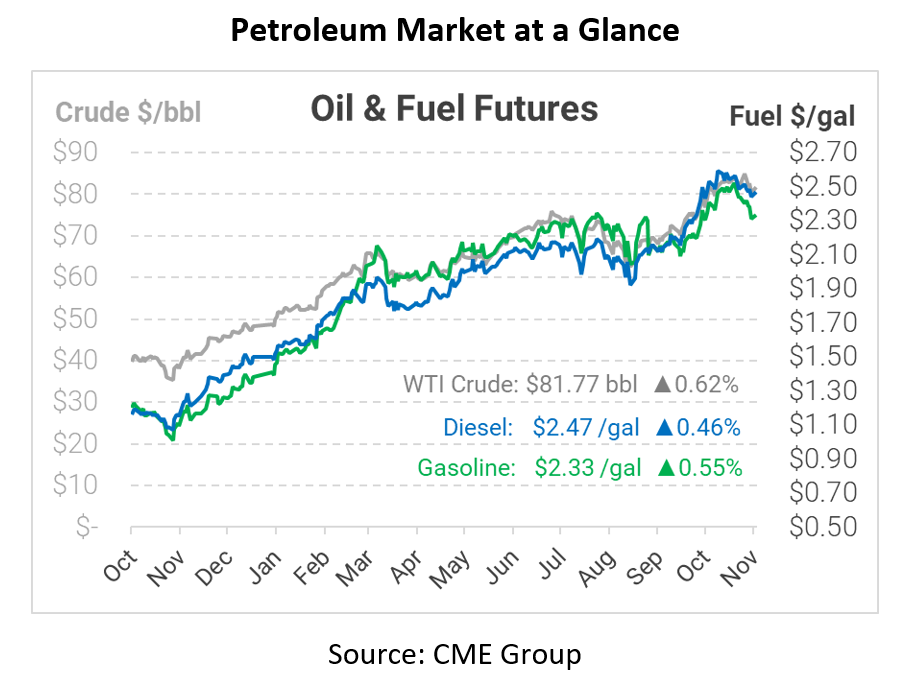

This morning, oil prices rose after a White House statement on oil after dropping nearly 2% last week. With the US speaking out about the issue with higher oil prices, this is a positive sign for economic growth as the world moves into a period where oil prices will be tested with winter on the horizon. Crude oil opened at $81.13, diesel at $2.4433, and gasoline at $2.3090.

On Saturday, OPEC+ had declined the request from the United States to help counter rising oil prices by increasing output which raised some obvious concerns. OPEC+ decided to stay with their current output plan of 400,000 barrels per day (bpd), therefore not exerting the downward pressure that an increase in output would exert. With oil prices hitting over $80 per barrel, consumers are demanding answers – and the Biden administration is under immense pressure to combat rising prices. During a White House press briefing, a report asked Biden whether or not he would consider tapping into the U.S. Strategic Petroleum Reserve. Biden responded with, “There are other tools in the arsenal…to deal with other countries at an appropriate time” to help change the current trend in the oil market. The last time a major tap into the strategic reserves was initiated was in 2011 when tensions with Libya reached a critical level. The other two major events during which the reserves were used were Hurricane Katrina in 2005 and Operation Desert Storm in 1991.

Given the significance of these past historical events, it appears unlikely that the Biden administration would consider releasing oil from the strategic reserve in the current market environment. Biden addressed the fact that before the OPEC+ meeting took place, he was leaning on the side of “unlikely” on whether the oil cartel would increase output. U.S. Energy Secretary Jennifer Granholm said that the forecasts from the Energy Information Administration (EIA) show that prices in December could fall to $3.05 per gallon, which could change Biden’s perspective on using the strategic reserves. With differing views from world powers on what will happen, only time will tell as we head into an extremely cold winter in the weeks to come.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.