The “Mexico Hedge” Is Back – Mexico Locks in 2022 Prices

Although considered a top-secret project, the “Mexico Hedge” seems to be underway. For over a decade, Mexico has hedged its oil production revenue, purchasing options that give them the right to sell at a certain price. Details of the hedge are a state secret to prevent traders from manipulating prices, though the pricing effects are sometimes visible in the marketplace. The hedge paid huge dividends in 2015, when crashing prices caused the hedge to generate $6 billion for the country.

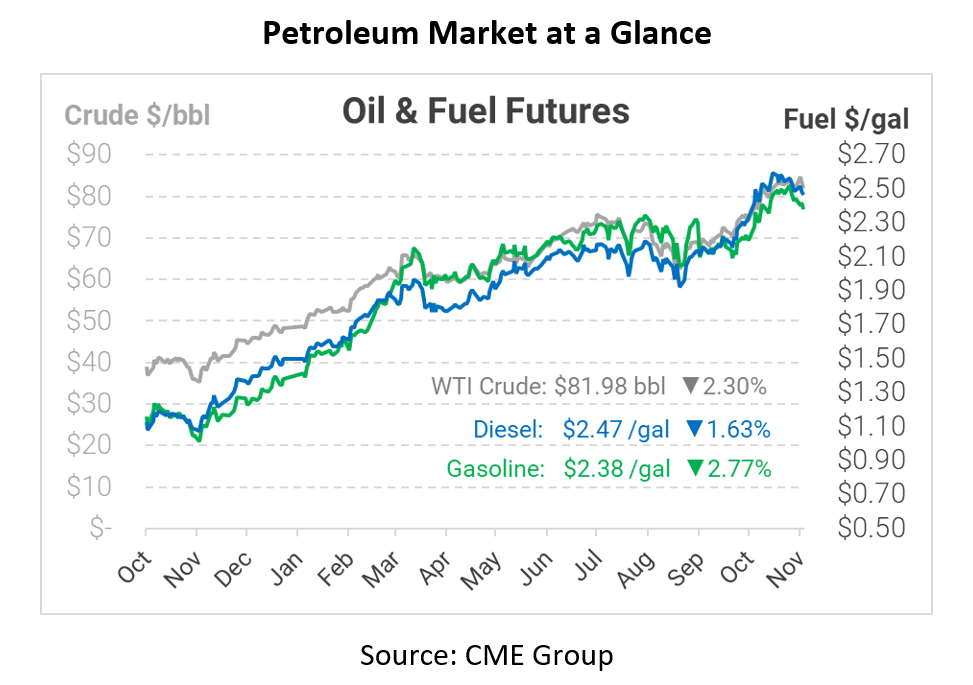

With volumes ranging from 200-300 million barrels, Mexico reportedly locked in a price around $60-$65, far below current rates but above the price received in recent years. Because markets are backwardated – meaning future prices are lower than current rates – Mexico cannot lock in $80 prices for the next year. That same pricing structure is a boon for consumers; while producers are stuck locking in lower revenues, consumers using fixed pricing can enjoy a discount on future fuel costs.

In other international news, China is facing a Delta variant “outbreak” across 19 provinces, leading to renewed concerns of economic instability in the world’s #2 economy. China is facing around 90 new cases per day, compared to roughly 75,000 new cases per day in the US. China has taken a zero-tolerance approach to spreading COVID-19; this weekend, it locked over 30,000 Disneyland tourists in the park for testing after a single tourist tested positive. China has reportedly warned citizens to stock up on critical goods in case lockdowns become necessary.

Finally, looking closer to home, President Biden announced regulations cutting methane emissions from oil and gas operations by 2030, which will require oil producers to spend an estimated $1.2 billion over the next 10 years to comply. The proposal was unveiled at the UN Climate Summit this week. Although the initiative has faced opposition from the oil and gas industry, some oil majors have noted a preference for the federal regulations in lieu of disparate state requirements. The move likely wouldn’t significantly impair production but might add costs for producers that would be passed on to consumers.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.