How Iran and China Are Making Your Fuel Prices Lower

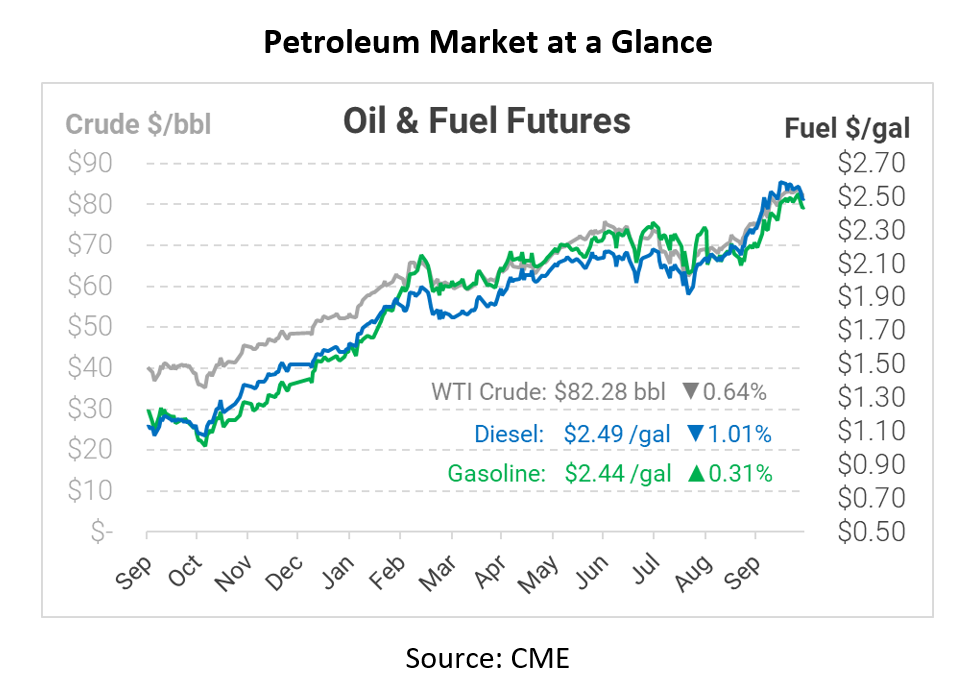

Fuel prices continue tumbling, providing some much-needed relief from the oil rally. After rising nearly 30% in the past two months, traders are finally beginning to see some relief, though major banks have suggested that bullish pressure could last throughout the winter. A confluence of factors, mainly stemming from abroad, are helping to bring the market lower this week.

Iran is back at the negotiating table. Ever since former-President Trump withdrew from the Iran nuclear deal in 2018, roughly 2 million barrels per day of Iranian oil have been kept off the market, contributing to the current supply crunch. Global powers are trying to broker a deal between the US and Iran, but progress has been limited so far. Traders are weighing the risk of 2 MMbpd returning to the market – even if the probability of a near-term solution is relatively low.

Along with Iran concerns, China’s coal market is helping to moderate fuel prices. Chinese coal prices have been tumbling, cut in half from the historic peak two weeks ago. Throughout October, analysts have sounded the alarm that coal and natural gas shortages would force power companies to use oil as their energy source. Although natural gas shortages in Europe are still a challenge, China seems to have reigned in the worst of its coal shortage. The Chinese government ordered domestic coal mines to increase output by 100 million tons, or 3% of the country’s annual demand. If these trends continue, it could alleviate some need to burn oil for power.

On the more bullish side, the OPEC+ technical group met to review market conditions, and re-affirmed the group’s current market outlook and production strategy. The alliance of countries have been increasing output by 400 kbpd each month – a rate that consuming nations consider far too slow to keep prices contained. Statements from various member countries suggest that OPEC+ will rubber-stamp November’s 400-kbpd increase at next week’s meeting. If OPEC+ comments are to be believed, consumers hoping for relief at the pump won’t find support from OPEC+ between now and the end of the year.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.