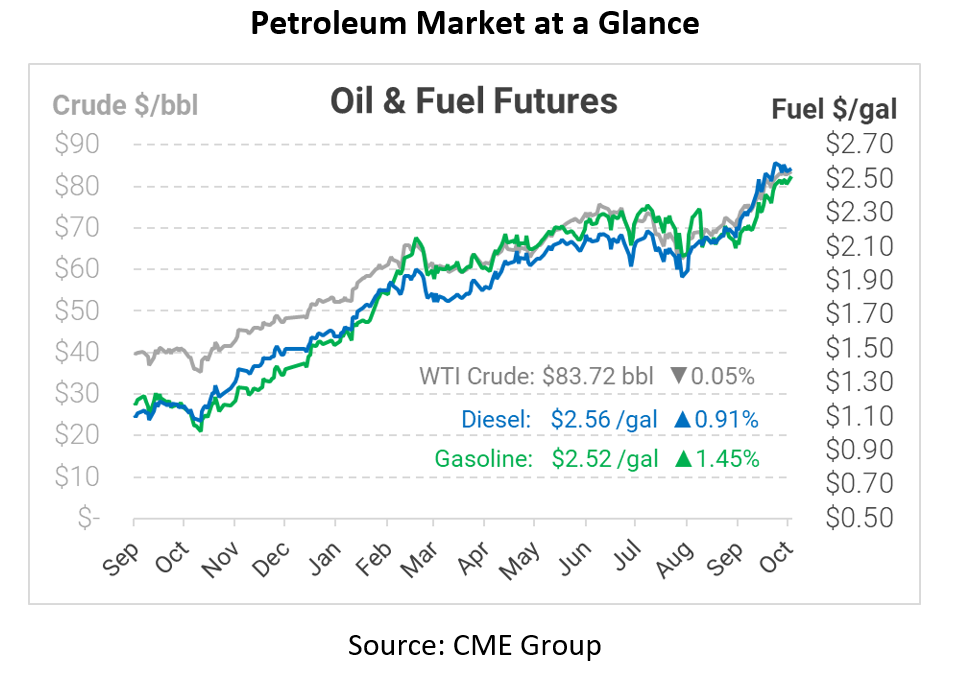

Driving with No Brakes – Runaway Fuel Prices?

Oil markets continue setting new highs, with diesel prices heading towards $2.60, a price not seen since October 2014. It’s worth noting that at no time in diesel market history have prices stayed at $2.60 –prices only pass that level on their way to $3/gal or higher prices. Major banks such as Goldman Sachs are calling for crude oil prices to reach at least $90/bbl this winter, at times trading even higher, which fits with the expectation that diesel prices will continue rising. More than ever, consumers are looking at the current price direction and considering locking in a short-term fixed price to ensure stable prices throughout the winter.

The rally seems relentless, with new headlines continuously pointing to higher prices. Last week, Baker Hughes reported that the North America rig count fell by 2 rigs. Increasing crude production requires adding oil rigs to drill new wells, so rising prices would typically bring much higher rig counts. Over the past seven weeks, rig counts have grown steadily, but this week’s decline shows their trepidation. US producers are accumulating cash and reducing debt rather than growing revenue, keeping global supplies low.

Since 2014, US shale production has kept a lid on oil prices, ramping up supplies when prices rose too much. Now, market pressures are keeping shale companies on the sidelines, so it’s no surprise that prices are moving back towards pre-2014 prices. Back then, $3/gal fuel was the norm. Without shale producers to tap the brakes and moderate the rally, oil prices could once again return to those elevated levels.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.