Fuel Market Are Backwards – How Consumers Can Benefit

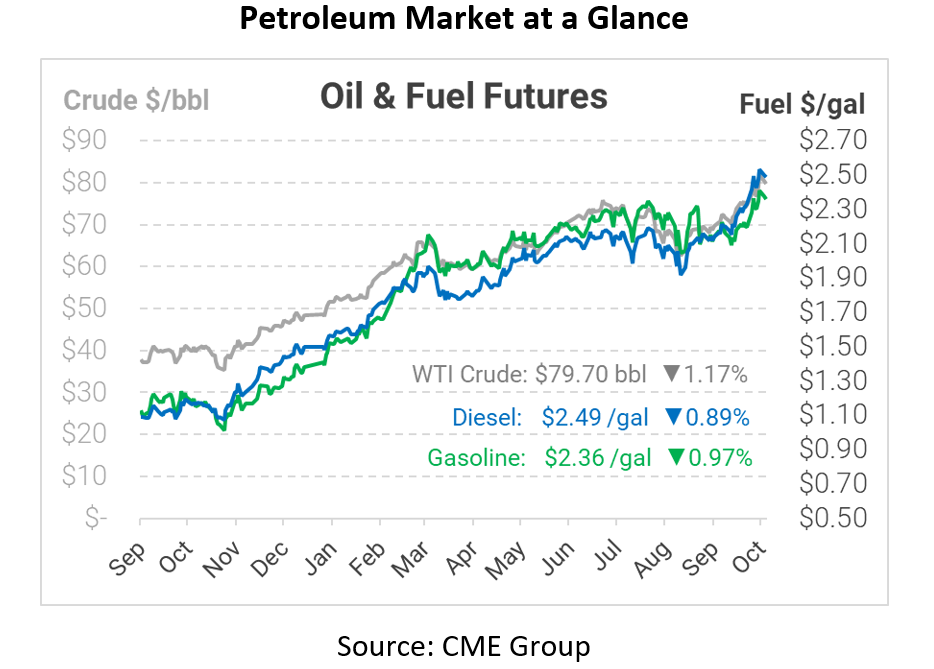

Oil prices are red across the board this morning, which is typical after a big rally. After surging above $80 on Monday, headlines have been abuzz with concerns of demand destruction and inflation. With so much focus on rapid price growth, how can fuel buyers control costs…and even use rising prices to their advantage?

In the US, crude prices have become steeply backwardated, meaning that current prices are dollars higher than 2022 future prices i. The pricing structure suggests that markets are tight currently, so don’t expect any quick relief at the pump. Price differentials between November and December future prices climbed over $1/bbl, the highest spread since 2019.

Why do future price spreads matter? If you’re an oil supplier holding inventories, a backwardated structure tells you that holding oil in inventory will not only incur storage costs, but also cause you to lose money over time. Oil suppliers respond by selling as much product into the tight market as possible, causing inventories to sink. That’s fine if high prices lead to more supply, but both US and OPEC producers seem intent on keeping output low – a perfect storm for oil prices.

For fuel consumers, there’s an entirely different reaction to a backwardated market. Backwardation typically means oil prices will rise in the future, especially when supplies cannot keep up with draining inventories. But for consumers who utilize fixed pricing, backwardation can be viewed as a discount. A fuel buyer can lock in 2022 prices well below current prices. For example, a Dec21-Dec22 average NYMEX price would be $2.38 as of this morning, roughly 12 cents cheaper than current prices. By locking in one rate for that whole period, buyers would instantly be able to enjoy the lower prices in the short-term, while maintaining a steady rate over the long-term.

Want to learn more about fixed price and risk management strategies? Click Here.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.