Oil Prices Fall After Inventories Gain

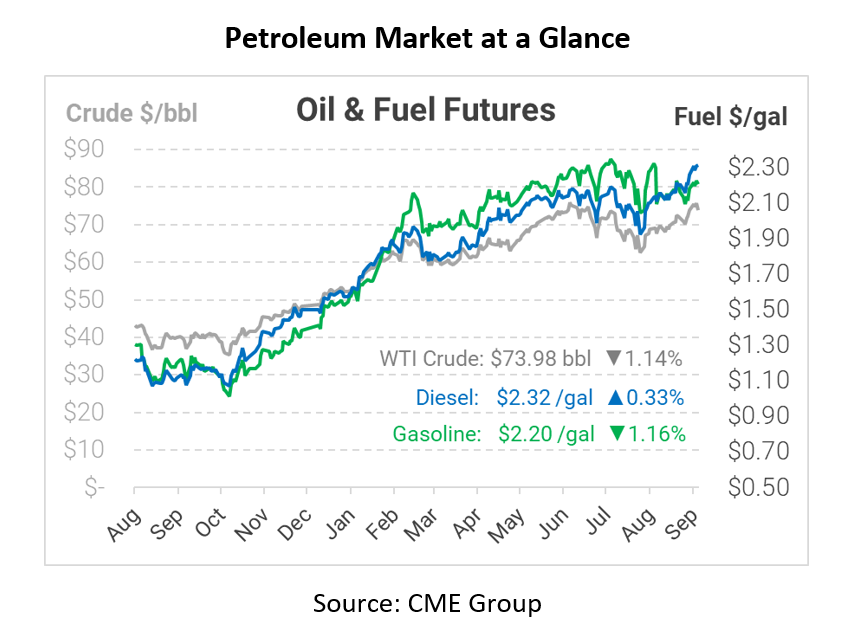

Today oil prices fell over $1.50 a barrel as inventory reports show a sharp increase during the week of September 24. This rise in inventory levels and the stronger dollar have clouded the recent supply forecasts predicting deficits in the future. Crude oil opened the day at $74.78, diesel at $2.3180, and gasoline at a price of $2.2300.

During the week of September 24, United States oil inventory levels rose by 4.6 million barrels. This rise was associated with increased production output in the Gulf following Hurricane Ida that knocked out a majority of fuel infrastructure in the Gulf of Mexico. The total inventory level ended last week at 418.5 million barrels, according to the Energy Information Administration (EIA) who released numbers yesterday. This increase in inventories was accompanied by a rising United States dollar that reached a one-year high. The new USD high makes oil more expensive for those trading with foreign currencies, which will certainly be a trend to pay attention to in the coming weeks.

Along with the stronger U.S. dollar, there is uncertainty hovering around what will happen with projected supply deficits. Even with supply starting to ramp up, Citigroup is still forecasting oil balances to show a deficit of around 1.5 million bpd over the next six-month period. In order to boost supply in the market, OPEC+ has also agreed to meet next week to consider adding 400,000 bpd to the supply chain for November.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.