Oil Rally Stalls on Oil Inventory Build

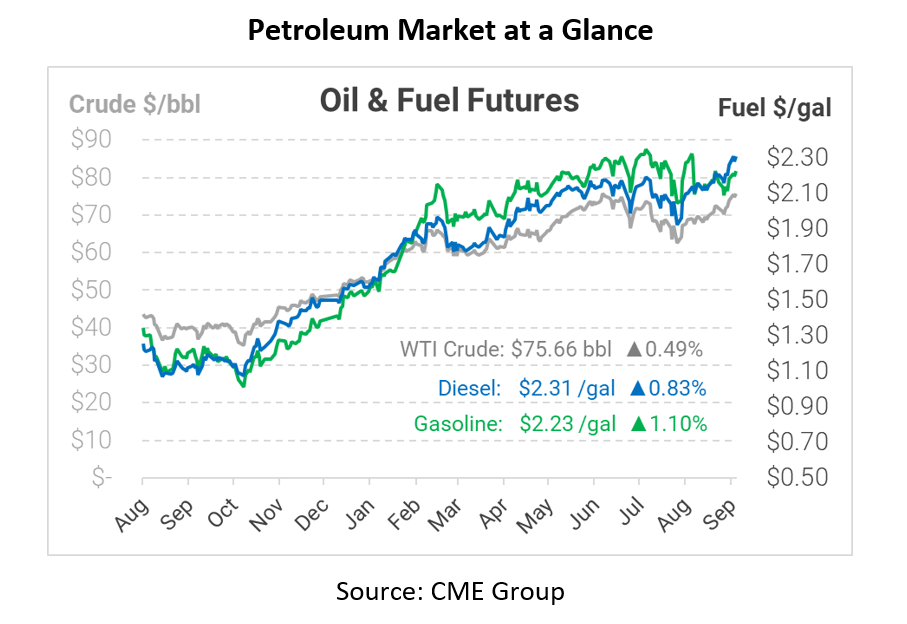

Fuel markets are trading mostly flat after some upward activity yesterday, which left WTI crude oil above $75/bbl. This EIA posted across-the-board inventory draws, giving markets a bearish sentiment this morning. Crude oil stocks rose by 4.6 million barrels – the first build in two months – while gasoline and diesel each rose by small amounts. That’s putting a damper on the recent rally, which has pushed crude oil prices up by $5/bbl over the past year.

Despite bearish news today, oil analysts have grown increasingly confident that prices will rise in the coming months. Goldman Sachs is calling for $90/bbl this year, and the oil trading giant Trafigura is now hinting at $100/bbl oil by the end of 2022. Bank of America Global Research, which had set a target of $100 in 2022, now thinks that level could be hit this year. On the other hand, the EIA is calling for a price decrease next year, based on the forward curve showing lower rates. The picture for Q4 2021 and beyond remains unclear, but many analysts are excepting it to be a tough period for consumers.

Part of the bullish trend has been caused by Gulf oil producers, where a large chunk of output remains offline. According to Reuters, many operators continue struggling to restore oil flows. On the other hand, BP is increasing output from new rigs in the area, which may alleviate some of the supply challenges in the Gulf Coast.

This article is part of Daily Market News & Insights

Tagged:

MARKET CONDITION REPORT - DISCLAIMER

The information contained herein is derived from sources believed to be reliable; however, this information is not guaranteed as to its accuracy or completeness. Furthermore, no responsibility is assumed for use of this material and no express or implied warranties or guarantees are made. This material and any view or comment expressed herein are provided for informational purposes only and should not be construed in any way as an inducement or recommendation to buy or sell products, commodity futures or options contracts.